Displaying items by tag: Wind Farms

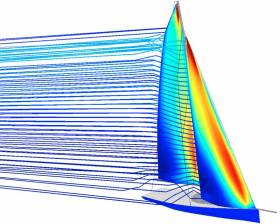

Sailing Technology Inspires New Cloth Blades For Wind Farms

#SeaPower - Edinburgh-based ACT Blade has designed a textile blade for wind turbines that could increase energy production by nearly 10%.

The company, an offshoot of racing yacht sail specialist AMAR Azure, designed the blade as part of the Offshore Renewable Energy (ORE) Catapult’s Innovation Challenge.

ORE Catapult then led a study that identified the company’s technology could be used to produce a textile blade up to 50% lighter and 30% stiffer than conventional fibreglass equivalents, said ACT Blade’s Sabrina Malpede.

“I didn’t have knowledge of the renewable energy sector and needed to qualify my theory with sector experts,” she added.

“From these insights we were able to create the ACT Blade, the world’s first textile blade, capable of capturing more energy than a fibreglass blade by covering a larger swept area, significantly increasing annual production.”

ACT Blade says the design has the potential to increase energy production by 9.7% and reduce the levelised cost of energy by 8.7%.

ORE Catapult research and innovation project manager Vicky Coy said: “This is just one example of how technology can be adapted from one sector to create something genuinely groundbreaking in another industry.

“There are very few innovations in any field that deliver such a dramatic performance improvement with one fell swoop. This is a tremendous opportunity not just for ACT Blade, but for the UK to establish a new textile blade supply chain for the global marketplace.”

Wind Farm Rock Berms Pose a Hazard for Boaters Says RYA

#MARINE WARNING - As wind farm projects expand around the coasts of the UK and Ireland, the Royal Yachting Association (RYA) has raised concerns about an unexpected hazard for boaters navigating near such installations.

Taking the London Array and Kentish Flats wind farm areas in South East England as a case study, the RYA explains how rock placements, or rock berms, have been put in place to protect the power cables from these arrays at the points where they cross in shallow water.

The RYA warns that as cable crossing become more likely and more frequent, as offshore energy projects expand around the coastline, the potential for accidents is greatly increased.

"It is this cable protection that in shallow waters can reduce underwater clearance and therefore pose a risk to navigational safety," said the RYA.

Referring to the London Array and Kentish Flats specifically, the association said it "was not aware that the cables would have rock protection until we received a notice.

"It would seem that the Marine Management Organisation, Trinity House and the Maritime and Coastguard Agency were also unaware that the developers were placing a rock berm in [the[ area and are investigating how all this happened 'sight unseen' - particularly as it seemed that the original London Array Limited applications had stated that the cables would be trenched."

The RYA has more on the story HERE.