Displaying items by tag: Ferry news

#CancelledSailings - Plans of thousands of holidaymakers have been thrown into disarray after technical problems forced the cancellation of this weekend’s sailings of Brittany Ferries flagship Pont-Aven vessel between Cork and France.

The Irish Examiner writes that the French ferry and holiday company confirmed last night that the Pont-Aven’s scheduled sailing on Friday from Rosscoff to Cork, and its Saturday sailing from Cork to Rosscoff have both been cancelled.

They are among several Pont-Aven sailings between Ireland and England to France and Spain, which have been cancelled this week after the vessel developed propeller problems.

A Brittany Ferries spokesperson said: “Brittany Ferries is endeavouring to contact all affected passengers as soon as possible with advice and available options.

“Passengers are being asked to be patient as there may be difficulty in contacting Brittany Ferries due to the volume of calls.”

The spokesperson encouraged passengers to check the company website for sailing updates.

“The company apologises to all passengers for the inconvenience this will cause to journeys,” she said.

The Pont-Aven, Brittany Ferries’ flagship vessel, entered service in 2004.

The newspaper which mas more to report here also adds that plans announced two years ago to replace the vessel have been put on hold, it has emerged.

Dun Laoghaire-Holyhead Ferry Faces Further Delays Until Potential New Operator in 2017

#FerryBut2017? – Restoration of the Dun Laoghaire-Holyhead ferry service this season faced a setback as facilities in the Irish harbour will not become available until at least 2017, writes Jehan Ashmore.

In responding to questions from Afloat.ie as to the delay, a Dun Laoghaire Harbour Company (DLHC) spokesperson cited that Stena Line (former route operators until 2014) have begun this week to remove HSS berth infrastructure in the harbour as previously reported.

Work is expected to be completed by August this year and DLHC added that the harbour facilities will only become available for use by a potential new ferry operator from 2017.

This will be the second successive season in which there will be no summer ferry sailings on the Holyhead route.

It was in 2015 that Stena Line finally confirmed in the permanent closure of the historic route dating to 1835.

The decision followed recent years of losses incurred on Welsh route. The link was served by highspeed sea-service (HSS) Stena Explorer until the fast-ferry was withdrawn in September 2014.

Less than half a year later, the Dun Laoghaire Harbour Company (DLHC) through a E-Tendering process received seven expressions of interest from operators to provide a seasonal-only ferry service. Before DLHC had received these responses, the harbour company said that any new potential operator would not be serving the route until at least 2016.

The 1,500 passenger HSS Stena Explorer had begun service in 1996, however from 2011 the Dun Laoghaire-Holyhead route was reduced to a seasonal-only service running between April and September. The sailing schedule consisted of only a single daily round-trip that was part of a raft of measures to reduce high running costs in a declining market and competition from airlines.

Stena’s departure from the Dun Laoghaire route led directly to the ferry firm consolidating existing operations out of the neighbouring port of Dublin. This was achieved by enhancing services to Holyhead by replacing Stena Nordica, with larger Stena Superfast X to partner Stena Adventurer.

In late 2015 Stena Explorer was sold to Turkish owners and as reported only yesterday on Afloat.ie, the Finnish built catamaran car-carrying craft is now back on the market for £4.5m.

Current owners, Karadeniz Holdings having abandoned plans to convert the craft renamed One World Karadeniz into a floating office in Istanbul.

#HSSforSale - Stena Line’s former Dun Laoghaire-Holyhead fast ferry, HSS Stena Explorer is up for sale again for around £4.5m - just months after it was sold as previously reported on Afloat.ie

The Stena Explorer, once one of the world’s fastest large ferries, was sold in October to Turkish firm Karadeniz Holding who were planning to convert it into a high-tech floating office.

It was taken from Holyhead to Turkey last year and as Afloat adds following the withdraw of the HSS craft from the route that closed in September 2014.

But now the ferry - that originally cost £65m and first came on the Holyhead to Dun Laoghaire route in 1996 - is available to buy again.

Its price has fallen somewhat since its unveiling 20 years ago and is now available for $6.5m, around £4.5m.

For more on the story, the Daily Post has a report here.

In addition to Afloat's report of a project to dismantle the Stena HSS berth in Dun Laoghaire Harbour.

Disused Stena HSS Berth to be Removed from Dun Laoghaire

#HSSberth – The disused Stena HSS berth at Dun Laoghaire Harbour is to be dismantled and removed in a process taking up to 10 weeks to complete, writes Jehan Ashmore.

Planning permission was granted to Stena by Dun Laoghaire-Rathdown County Council to dismantle berth No. 5 at St. Micheal’s Pier from where the final HSS Stena Explorer sailing to Holyhead took place in September 2014.

The operator having consolidated existing services on the Dublin Port route to the Welsh port that began in 1995.

Work at No. 5 berth is where the specialist docking infrastructure designed only for Stena HSS 1500 class fast-ferries, is to involve the removal of the linkspan, gangway and associated equipment.

A tug, MTS Valour is to begin towage of a barge from Stranraer, Scotland to Dun Laoghaire where the HSS related structures are to be loaded on board.

Coincidentally, Stranraer is also where Stena operated the HSS Stena Voyager in tandem with a pair of ferries on the Belfast route until switching Scottish ferryport to Cairnryan in 2011.

Also as part of the works in Dun Laoghaire (see Notice to Mariners No. 9) will be the removal of the pontoon at No 4 which is the adjacent berth on St. Micheals Pier. This berth-linkspan was last used by the smaller fast-ferry, Stena Lynx III until 2011.

Afloat.ie awaits a response from Dun Laoghaire Harbour Company to finally confirm proposals to restore seasonal-only ferry services to Holyhead, having begun a tendering process in February 2015.

Only in recent months saw the retail letting opportunity of the former ferry terminal and now the project to remove ferry-related infrastructure from the port.

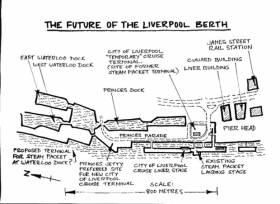

#LiverpoolBerth - Before plans for a new landing berth in Liverpool for the Isle of Man ferries can go ahead, several questions must be answeered says TravelWatch.

The IOM Today writes that the passenger watchdog held a public meeting last Thursday when numerous issues were raised.

Infrastructure Minister Phil Gawne MHK has visited Liverpool to meet the city’s Mayor Joe Anderson to discuss plans to relocate the Steam Packet berth from its historic Pier Head location to make way for a cruise liner terminal. A new site to the north at Waterloo Dock has been earmarked for Manx ferries.

The proposed new landing stage will be almost half a mile away from the current one.

The cost of the move has been estimated at £15m, but Mr Gawne has described that figure as ‘ridiculously optimistic’.

For further coverage on plans for the ferry terminal relocation, click here.

#SeasonStarts – CalMac’s Ardrossan-Campbeltown (Mull of Kintyre) summer-only ferry route which began on a trial pilot basis in 2013, resumed seasonal service last week on what is now a ‘permanent’ route in the Scottish operators network, writes Jehan Ashmore.

The permanency of the Ayrshire-Kintyre route in south-west Scotland was announced in January by Minister for Transport and Islands, Derek Mackay following three successful summer seasons.

In total the route transported an average of over 10,000 passengers and 2,000 cars annually on the season route that began in April and concluded at the end of September. This season the route that began almost a week ago by Isle of Arran (1984/3,296grt) will continue operations up to the 25 September and the permanent route is part of an enhanced summer timetable for CalMac services.

Prior to last week’s reopening, Afloat noted that the Isle of Arran had received a scheduled dry-docking at Cammell Laird, Birkenhead. The veteran vessel dating to 1984 will as usual provide additional summer sailing capacity on the Arran service: Ardrossan-Brodick served by Caledonian Isles (1993/5,221grt).

According to the CalMac website, essential improvement works on the island port of Brodick are being carried out around to boarding and disembarking areas. Sailings will be unaffected by these improvement works.

#RoPaxReturns - Ropax Ben-My-Chree, the Isle of Man Steam Packet Company's Douglas-Heysham route ferry has returned to service with a sailing this morning from the Manx capital, following completion of her scheduled statutory biennial overhaul.

The 12,500 tonne ship, which has served the Island for 18 years, has been in dry dock for three weeks for her scheduled ‘service’. The work has included a technical overhaul as well as refreshing some of the passenger areas, including refurbishments to the seating, general decor and lighting in the Executive, Niarbyl and Premium lounges

During the overhaul MV Arrow has maintained freight services whilst fast craft Manannan has operated scheduled passenger services to Heysham, Liverpool and Belfast.

Larne Guesthouses Feel Pain after Loss of Troon Service

#PortofLarne - Providers of accommodation in Larne, Co. Antrim according to The Newsletter, are fearing for their future due to plummeting visitor numbers, following the loss of the Troon ferry route.

The loss-making Irish Sea route, which traditionally ran from March to October, was officially scrapped by operators P&O Ferries in January.

And with the tourist season now in full swing, a number of Larne businesses are beginning to feel the inevitable fallout of the route’s withdrawal – with some guesthouses reporting that visitor numbers have halved.

The Larne Times spoke to several guesthouse operators in the town, who all confirmed they have experienced a substantial drop in business in recent weeks.

Ivy Chalmers of Derrin Guest House revealed that bookings over the past month have shrunk by about 40 per cent compared to the same period last year.

The newspaper has more, click here.

Afloat adds that P&O Ferries continue to operate the Larne-Cairnryan route which is operated year round by a pair of ropax ferries.

Investigation Launched into Blaze On Ferry From Holyhead

#FerryNews - The fire broke out on the Irish Ferries 2.40am (yesterday, Monday) Holyhead to Dublin crossing and normal services have now resumed.

According to the Daily Post, the firm’s largest ferry Ulysses, which can carry up to 2,000 passengers, was close to docking at Dublin Port when the blaze was detected at 5.45am.

A spokesman for Irish Ferries said the fire started in a lorry cab, however the cause has not yet been established.

There were no reports of any injuries.

He said: “We can confirm there was a small fire on Ulysses this morning, on the 2.40am Holyhead to Dublin service.

“The fire was detected immediately and didn’t spread to any other vehicles.

For more on the story, click here.

Steam Packet Offer Manx Government New Services Agreement

#ServiceAgreement - The Isle of Man Steam Packet Company has presented an ‘offer’ to the Manx Government for a new strategic sea services agreement to replace the user agreement.

The IOM Today writes that last summer the government issued an ultimatum to the Steam Packet – make us a ‘significantly enhanced’ offer or ferry services will be put out to competition.

Now the ferry operator’s chief executive, Mark Woodward, has confirmed an offer has been made which he hoped Tynwald will get the chance to support in the next few months.

The company has not yet disclosed details of the ‘offer’ but Mr Woodward told the Courier it will be made public and that it will involve investment in new ships.

Welcoming the appointment of Vision Nine as the new promoter for the TT and Classic TT, Mr Woodward said the offer to government would ‘help address the crucial issue of visitor capacity’.

For more on the story, click here.