Displaying items by tag: Limerick Docks

First Navy Service 'P60' Class Vessel to Visit Limerick, Docks this Evening in Advance of Riverfest Limerick's Ship Tours

For the first time ever a Naval Service 'P60' class vessel, LÉ James Joyce visited Limerick City Docks this evening with the historic call made to enable attending Riverfest Limerick held over the May Bank Holiday weekend, writes Jehan Ashmore.

LÉ James Joyce headed up the Shannon Estuary and as of this evening, Afloat tracked the OPV enter (1800hrs approx) into Limerick Docks, one of six terminals on the estuary operated by Shannon Foynes Port Company. SFPC is Ireland’s largest bulk port and Ireland's deepwater transatlantic gateway.

The maiden call LÉ James Joyce to the mid-west city, would of been seen from the vantage points of Steamboat Quay, Barringtons Pier and Shannon Bridge.

As part of RiverFest Limerick, free tours of LÉ James Joyce (P62) will take place in Ted Russell Dock on (Saturday and Sunday) between 09.30am-17.30hrs and in groups of 10.

Access will be made to the upper decks and bridge of LÉ James Joyce from where views of Ted Russell Dock will be made possible and nearby the adjacent banks of the Shannon which will be the epi-centre of the first major national festival of the year.

For information on the Riverfest highlights (incl. water-based activities) during the 4-day events programme ending, Monday 2nd May, click the festival website here.

The LÉ James Joyce (OPV) is the second of a quartet of P60 / Beckett class vessels which were all built by Babcock Marine's former Appledore shipyard. Now the north Devon yard is one of five shipyards that form H&W Group Holdings plc.

Since the LÉ James Joyce was commissioned in 2015, the OPV has been part of naval operations involving maritime security and defence patrols of the Irish coast. The maiden call to Limerick will see naval personnel during the tours be on had to discuss a broad spectrum of careers in the service.

The inugural arrival of LÉ James Joyce to Limerick Docks, was seen from those on the vantage points of Steamboat Quay, Barringtons Pier and Shannon Bridge.

Also currently in port is the short-sea coaster Arklow Castle which is berthed alongside the river berth close to the loch entrance to the Ted Russell Dock. The city's dock is SFPC's second largest general cargo port on the estuary which is based in the heart of the city.

The dock basin has 4.5 hectares of water area and almost 1km of quays from where vessels up to 152m long with a beam of 19.8m can be docked.

As Afloat previously reported the Limerick ketch Ilen's 700 mile voyage to London (which has since been completed this afternoon) following a final leg upriver of the Thames from Tilbury. See related, Tilbury cruise terminal's new client operator's maiden mini-cruise story.

The sailing vessel berthed at St. Katherine's Pier close to the St. Katherine's Dock and the landmark of Tower Bridge. It is on the other side of the bridge that LÉ James Joyce has previously visited the Pool of London whilst moored alongside HMS Belfast.

The historic ship, HMS Belfast, a WW2 Town class light battle cruiser built by H&W, Belfast is open to the public as a floating museum.

Limerick Docks Plan of Floating Data Centre

#Shannon - A €35m revolutionary floating data centre in Limerick Docks is being planned in a move which could create 124 jobs.

As The Limerick Leader writes the city has beaten a number of locations across Europe to the investment, with Minister of State Patrick O’Donovan hailing it as “yet another element of the city’s rejuvenation”.

With centres providing information technology power for businesses being highly sought after, the Shannon Foynes Port Company has teamed up with Californian firm Nautilus, which plans to moor a floating vessel providing commercial data storage at Ted Russell Dock.

For further reading on the proposed project, click here.

West Coast's Limerick Trading Celtic Spirit's Successor Seen Along East Coast Ports

#IrishPorts - Afloat previously reported recalling in Limerick Docks more than a decade ago of a general cargoship Celtic Spirit whose successor sharing the same name recently called to Wicklow Port, writes Jehan Ashmore.

To recap, firstly the call of the past to Limerick in 2006 involved Celtic Spirit (1976/2,978grt) that was loaded with round timber (logs) then a newly formed trade. On the call by the current Celtic Spirit (1996/2,840grt) to Wicklow last week, this followed a departure of the ship's owners homeport of Cardiff, Wales.

The single box hold Celtic Spirit is operated by Charles M Willie Shipping Ltd, whose ships funnels are adjorned with a crest depicting an adaptive version of the Welsh flag with distinctive dragon. Also incorporated is a 'W' representing the intial of the shipowners also engaged in managing, charterering and liner operations. As reported in the coverage from Limerick, a pair of Arklow Shipping vessels in recent years were acquired by the Welsh shipping interests.

Celtic Spirit arrival to Wicklow took place last Friday and on the next day of the October Bank Holiday weekend, loading began of solid recovered fuel (SRF) which is waste used for incineration. The shortsea trader remained at the east coast port into the early hours of Sunday morning, then headed north bound for Sodertalje in Sweden.

Also tracked Scot Isles which too had berthed in the same Cardiff Docks of Queen Alexandra Dock. The ship operated by Scotline has over the years been a regular trader to Wicklow and where on the Bank Holiday Monday discharged a typical cargo of packaged timber originally from Sweden.

Funding For New Tidal Energy Project At Limerick Docks

#SeaPower - A prototype tidal energy turbine project in the Shannon Estuary has received almost €100,000 in funding for further development, as the Limerick Post reports.

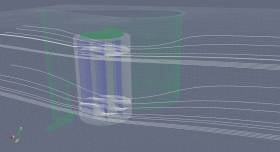

GKinetic has been testing a scale prototype of its new hydrokinetic turbine for the last year, at a purpose-built facility in Limerick Docks set up in tandem with the Shannon Foynes Port Company.

The new funding of €99,562 from the Sustainable Energy Authority of Ireland’s (SEAI) Prototype Development Fund will support testing on an improved prototype from August for a six-week period, as the company ramps up plans to scale up the design to a 250kW tidal device.

GKinetic’s technology is already being commercialised by fellow Co Limerick company DesignPro, who secured funding earlier this year under the Horizon 2020 project to test its own river energy devices at scale.

The Limerick Post has much more on the story HERE.

Masterplan for Shannon Foynes Port Company

Port expansion options are to be examined so to prepare ports for larger trade volumes when the opportunities arise. Also under consideration are the non-core assets at the Port of Foynes and Limerick Docks. To read more about the masterplan and the challenges and issues that has been identified in both ports click HERE.

The statutory jurisdiction of the estuary is under the control of SFPC, which is responsible for the estuary that runs from the mouth entrance marked by Kerry and Loop Heads and stretching far inland to Limerick City. The natural waterway can handle vessels of up to 200,000 deadweight tonnes (dwt) which are the largest ships that can dock in Irish waters.