Displaying items by tag: boat sales

Classic Dublin Bay 'Colleen' Class Reproduction for Sale: Perfect for a Timeless Sailing Experience

A classic reproduction of the early Dublin Bay "Colleen" class is up for sale at €9,750.

Doyle of Kingstown - Dun Laoghaire designed this stunning GRP boat, an absolute head-turner. With a gaff rig, main and jib, and simulated clinker construction, this boat is a real gem.

The 50kg centre plate and cockpit combings add to the boat's character, making it an ideal three-person day boat.

This boat is perfect for day sailing, short coastal passages and classic regattas. It's a custom road trailer and reserve Honda outboard, making it a hassle-free option for those who want to enjoy sailing without the big boat bills.

Ronan Beirne at Leinster Boats is the contact for anyone interested. Read the full advert here

Transatlantic Race Winning Classic Ketch Cuilaun of Kinsale For Sale

The 55ft McGruer designed-and-built ketch Cuilaun of 1970 vintage – still renowned for her immaculate varnished topsides even after more than a half century of very active sailing life on both sides of the Atlantic – has to be Ireland's best-known offshore classic yacht. Built at Clynder in Scotland in 1970 to the designs of George McGruer for the late Michael O'Flaherty, she was originally Cuilaun of Kinsale. But with Brian Smullen as an energetic, enthusiastic and very effective sailing master, she was soon logging many miles to other place beyond the horizon.

In time, she simply became Cuilaun, and her ownership became jointly in the names of Michael and Brian. If anything, the yearly mileage increased, and often at very good speeds, so much so that in 1979 she won the International Transatlantic Race to Cork, albeit in flat-out racing mode as her crew included several noted hotshots including a future Commodore of the RORC.

"Wrap the green flag round me…." Wherever she may ultimately have been based, Cuilaun's heart stayed in Ireland, as demonstrated here as her crew determinedly make the best of winds rather lighter than she prefers.

"Wrap the green flag round me…." Wherever she may ultimately have been based, Cuilaun's heart stayed in Ireland, as demonstrated here as her crew determinedly make the best of winds rather lighter than she prefers.

So ubiquitous was her life-enhancing presence that for many years, whether it was in Antigua, Newport, Maine, Glandore, Cowes, Saint-Tropez or wherever, the fleet in a Classics Regatta never seemed quite complete without Cuilaun in the midst of it, allegedly "just a comfortable and elegant cruising ketch", yet sailing with a performance which went well beyond that.

Now, after 51 years of great sailing and much enjoyment supported by an annual maintenance programme of world standard, Cuilaun is for sale for the first time through noted brokers Sandeman.

"The Life-Enhancer" – Cuilaun adding style to the Glandore Classics. Photo" Gary Mac Mahon

"The Life-Enhancer" – Cuilaun adding style to the Glandore Classics. Photo" Gary Mac Mahon

Second-Hand Boat Scenarios Covered by the EU’s Recreational Craft Directive & UK’s Recreational Craft Regulations

Following the successful cooperation on VAT and customs, the leading European, British, and international leisure marine associations continue to provide clarity on the new post-Brexit trade relationships.

The International Council of Marine Industry Associations (ICOMIA), European Boating Industry (EBI), European Boating Association (EBA), British Marine (BM) and the Royal Yachting Association (RYA) now issue a clarification on certification requirements for second-hand boats in trade between the EU and UK post-Brexit.

In dialogue with the EU and UK authorities, the key questions were raised, and clarification received. EBI has been liaising with the European Commission and BM has taken the lead with the Department for Business, Energy and Industrial Strategy (BEIS). The scenarios have been confirmed by BEIS and are understood to be correct based on guidance by the European Commission.

Below are the scenarios for second-hand boats that are covered by the EU’s Recreational Craft Directive and the UK’s Recreational Craft Regulations. In cases where recertification would be required, a Post-Construction Assessment (PCA) will have to be completed. This applies from the end of the transition period (TP) on 1 January 2021.

Second-hand boat scenarios covered by the EU’s Recreational Craft Directive & UK’s Recreational Craft Regulations

Further clarifications are being sought from BEIS and the European Commission related to trade with Northern Ireland.

Commenting, Philip Easthill, Secretary General of EBI, says: “We are delighted to continue the positive cooperation on another important issue for industry and boaters. We hope that despite the additional barriers for second-hand boats, the clarification on VAT and now certification will facilitate trade as much as possible. Together with our partners, we will continue to work on mitigating the impact of Brexit through our advocacy channels at EU level.”

Lesley Robinson, CEO of British Marine, adds: “I am pleased that this collaborative approach between marine industry associations and governments has proved effective in receiving timely responses for our members. Whilst the agreed guidance approved by both BEIS and the EU Commission offers boat builders, brokers and consumers the clarity and reassurance required to proceed with trade, they still face impacts in terms of both time and cost when selling and buying second-hand boats cross borders. On behalf of our members, British Marine will now look to work with UK government at the reduction or removal of these new burdens.”

Patrick Hemp, Technical Consultant of ICOMIA, added: “We are aware that the obligation to recertify CE-marked second-hand boats, which were in Great Britain at the end of the transition period and then subsequently imported into the European Union, will come as a surprise to many within our sector but we hope that the continued collaboration between the marine industry associations provides further clarity on the different requirements within the new trade relationship.”

Buying or Selling Boats in the UK Proves Costly Post Brexit

Two months after Brexit, there's no doubting the new seascape for importing boats into Ireland. VAT and tariffs' imposition means it is now a costly exercise to either buy or sell a boat in the UK, traditionally a big marketplace for Irish boat buyers and sellers.

Once a rich pool of well-kept boats at attractive prices, the handy UK market for second-hand boats now has 33% in taxes slapped on top since January 1st.

It turns out that when the greatest trade deal, either in the EU or UK, was being done, somebody forgot about the minuscule boat market. The resulting fallout from this lack of determination means brokers and buyers navigating the now choppy waters say there is little official advice to go on, and boats are being lumped in with cars for the official tax treatment.

Yacht brokers say there are lots of 'verbal' discussions going on but very little being put in writing as buyers, sellers along with both Her Majesty’s customs and their EU counterparts, get to grips with some complex new arrangements.

Such is the state of confusion, the British Marie trade body held a fully subscribed online panel discussion to provide members with the latest information on the EU-Trade and cooperation agreement but it was far from complete.

Global marine transport and logistics provider Peters & May is reporting a surge in enquiries from yachtsmen seeking advice and assistance about bringing boats back to the UK in time to avoid tax levies following the country’s departure from the EU.

Since 1st January, all boats moved between the EU and UK now require customs declarations at the border and face paying import VAT, although, for many, a ten-month window still exists in which to get boats home without facing this charge. The rules state that UK VAT paid yachts must return to the UK within three years of having left the UK or EU and not have changed ownership in the meanwhile to qualify for Returned Goods Relief on VAT. There is a final deadline in place of 31st December 2021 for yachts to return if they departed more than three years ago.

Afloat knows of two British owners who contacted HM Customs before bringing boats back from the Mediterranean to the Solent. Luckily they did, as they were told both faces 20% in VAT on return. The haulier was cancelled in this instance while the boat owners work out what to do next.

Marine transport firm Peters & May is assisting UK yacht owners returning boats from abroad to avoid post-Brexit tax penalties

Marine transport firm Peters & May is assisting UK yacht owners returning boats from abroad to avoid post-Brexit tax penalties

With late changes having been made to HMRC’s guidance on how VAT on boats in the EU would be imposed, this has been a very confusing time for boat owners

At the moment, all dealers contacted by Afloat will say is the hope is that a deal can be done that somehow removes the current scenario even for a period of time, at least.

Brokers fear too that the real problem lies further down the road in the months and years ahead when tax authorities retrospectively scrutinise Bills of Sale, especially for boats with multiple owners over a five year period.

For the moment, it’s a case of the adage Caveat Emptor; make sure VAT is paid!

To the current situation? Regular readers will know Afloat previously described what Irish boaters need to know about buying vessels from Great Britain and now Afloat takes a leap of faith to examine the position from the Irish boat buyers and sellers perspective.

Buying or Selling a Boat in Ireland Post Brexit

Most boats being brought in to Ireland second hand from Great Britain will likely face a 33% tax (23% VAT and 10% duty).

There are similar implications for the Irish stock of used boats where sellers will likely have to seek EU clients instead or else reduce the asking price significantly if a UK buyer has to pay extra VAT.

Overall, EU people will mainly buy and sell used boats within the EU, while UK people will likely be mainly buying and selling used boats within the UK.

Post Brexit - Boats coming into Ireland

New Boats

The least problematic scenario. As previous, VAT is charged on entry from boats built in the EU and UK (as trade agreement in place)

Boats built outside these areas may be subject to tariffs also. For example, there is currently a 25% tariff on boats coming into the EU from the US.

Buying second-hand boats with VAT paid

If coming from the EU - As before, no VAT or tariffs provided VAT has been paid in the EU.

If coming from Northern Ireland, the NI protocol treats Northern Ireland as the EU, so no VAT or tariffs are applicable.

If coming from the UK (England, Scotland and Wales) and the boat was domiciled in an EU country on the 31st Dec 2020 at midnight, it is treated as EU VAT paid and brought into Ireland without VAT or duties. Proof of domicile will be needed.

If coming from the UK and the boat was domiciled in Great Britain on the 31st Dec 2020 at midnight, it is treated as UK VAT paid. This means that VAT and possibly a tariff will need to be paid if importing into Ireland, as follows:

- a. VAT. At the VAT rate in Ireland. Currently 21%, but this will revert to 23% on the 28th of February

- b. Duty If the boat was built in the UK—No Duty. If the boat was built in an EU country, then 10% duty. If the boat was built outside the EU, then possibly a different duty rate.

This is the same situation as is now happening with cars brought in from the UK, as the Irish Independent reported here.

This effectively means that most boats being brought in to Ireland second hand from Great Britain will likely face a 33% tax (23% VAT and 10% Duty).

Clearly, this is a scenario that will likely eliminate most second-hand purchases from Great Britain. Irish boat buyers will more likely now be looking at France, Holland, Belgium, Germany, Portugal and Spain for their second hands.

An example:

- Used Jeanneau Sun Odyssey 32 sailing cruiser bought in France at 45k. No VAT or Duty.

- Used Sun Odyssey 32 sailing cruiser bought In England at 45k. 23% VAT (€10,300) and 10% duty (€4,500) to be paid. Total circa €60,000

Selling an Irish boat into the UK

This will also likely be costly. A used boat from anywhere in the EU will now likely have to pay UK VAT on entry to the UK, presently 20%. This means that the Irish stock of used boats will likely have to seek EU clients or reduce the price significantly if a UK buyer has to pay this extra VAT.

Irish Boaters Warned of UK Online Boat Sales Scam

An Irish boater believes he was the victim of an elaborate UK boat sales scam that is targeting Ireland and using a legitimate UK firm's business address.

A west coast based sailor paid for two boats this week after viewing them online only never to hear back from the company again.

"I thought the prices were too good to be true and as it turns out, they were", the Shannon Estuary sailor told Afloat.

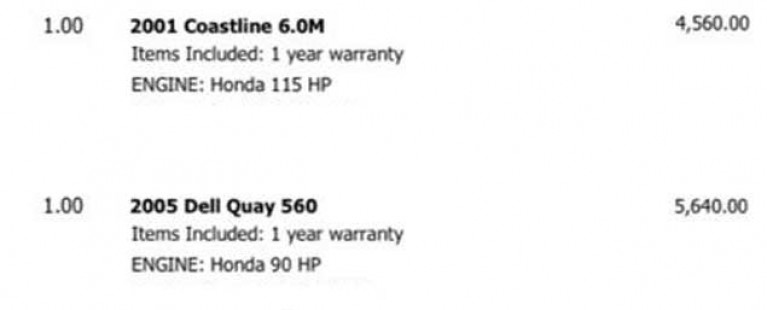

A 2001 six-metre Coastline RIB with a Honda 115hp engine at £4,560 and a 2005 Dell Quay 560 with Honda 90hp engine at £5, 640 were paid for online but the Irish customer grew suspicious when emails then went unanswered.

"He wasn’t getting back to me so I said I’d cancel the money and send a friend to the UK address and they told him it was a scam", the man told Afloat.

Fortunately, the Irish boater contacted his bank and managed to stop the payment going through.

He has since completed further research online and discovered the extent of the scam that may already have caught two or three Irish boaters.

The matter has been reported to the Garda.

Online comments indicate that a fraudulent site is using legitimate UK company details to perpetrate an "Authorised Push Payments Scam".

European Brokers Hampered By New EU Tariffs On US Pleasure Craft

#Trade - European importers of pleasure craft from the US have already been impacted by new EU tariffs that add an average of €20,000 per boat.

According to Boating Business, dealers across Europe have been placing orders for new boats on hold since the tariffs came into effect in June as part of the response to the Trump administration’s steel and aluminium levies.

Yacht transport companies are also affected by the situation as the majority of their small boat business is from the US to European markets, says logistics specialists Peters & May.

The new rules apply to all pleasure craft in transit since 22 June, regardless of size, with only inflatable boats excepted.

And the increase from 17% to 25% on import costs is having what are perhaps unintended consequences for European brokers.

“The duty is intended to protect our industries, but we sell waterski and wakeboard boats which are not made over here,” says Jason Bates of Nautique Midlands in the UK.

Boating Business has more on the story HERE.

Boats For Sale: Go West For Your First Chance

It says much for the growing reach of Leinster Boats that a Galway-based owner has turned to Ronan Beirne’s Dun Laoghaire firm to sell on his First 310 writes W M Nixon. The boat is advertised on Afloat Boats for Sale. This is a boat which is something of a collector’s item, for although the First 31.7 is well established as a One Design class in Dublin Bay, the earlier 310 dating from the 1990-1994 period is somewhat rarer in Ireland.

That said, the mighty Beneteau organisation built 496 of them for the home and international market, and this one has all the features which made the Finot-designed First 310 such an attractive proposition 25 years ago, when her high volume hull made her seem palatial by comparison with more traditional boats of the same overall length.

As we are now discovering, good fibreglass construction seems well able to last for ever, and today’s marine industry is able to provide specialists who can make a 25-year-old boat seems as good as new. At an asking price of €29,500, she’s certainly of interest, and is currently laid up ashore in Galway city to provide speedy viewing.

See the full advert here.

Lynx, The INSS Reflex 38, is Seriously for Sale at €60k

Lynx, the successful Irish offshore Reflex 38 racer that has featured at the top of Ireland's offshore racing fleets for the past five seasons or more is seriously for sale by current owners, the Irish National Sailing School (INSS) in Dun Laoghaire.

Originally designed for Sir Robin Knox Johnston's infamous Clipper Ventures, Lynx, says INSS principal Kenneth Rumball, 'is the best Reflex out there'.

Well campaigned in Galway before coming to Dun Laoghaire as the Irish National Sailing & Powerboat School's race boat, the yacht was overall winner of the 2011 Dun Laoghaire to Dingle race.

The yacht, under Galway colours, took a class win and fifth overall in Round Ireland 2012.

Over the winter of 2015/2016 she went through a 'no expense spared' refit for the Round Ireland campaign in 2016. Much work was done including a full IRC re-measurement and optimisation, major engine and sail drive overhaul, new sails, new upholstery, new sheets and halyards and the hull stripped back to the gelcoat, re-faired and treated to Nautix T4 hullspeed antifouling.

The refit was well worth it because the Christian Stimson design was tenth overall and top sailing school yacht in 2016's bumper Round Ireland fleet.

Rumball, who has campaigned the boat in the ISORA series, says he is open to reasonable offers. Read the full advert for the boat on Afloat Boats for Sale here

Strong Start to Southampton Boat Show, Irish Marine Firm Reports Good Enquiry Level

The 48th Southampton Boat Show kicked off to a fantastic first four days over the weekend with strong sales results being reported and Irish boat firms are among the winners in boat brokerage business.

An impressive 23 brands made their World debut on opening day, Friday 16 September, from the likes of global brands Oyster Yachts, Princess Yachts, Bavaria Power, Sunseeker International and Haines Marine. Seven others will have made their European debuts, with 72 UK debuts and 33 new boats being welcomed to the Show over the next seven days.

Over 1,500 have already got out on the water for free with the Show’s Try-A-Boat attraction which sees visitors climb onboard the latest RIBs and luxury yachts, and the Get Afloat! area, where 8-16 year olds can try out dinghy sailing and Stand Up Paddleboarding.

Murray Ellis, Managing Director of British Marine Boat Shows, comments: “We’ve had a terrific start to the 2016 Show. We are already hearing of strong sales reports from our exhibitors with many reporting an increase compared to this time last year. As a global Show, attracting exhibitors and visitors from around the world, this is an important aspect of retaining the strong business reputation of the Southampton Boat Show.”

'It has been very busy so far on this stand and we are up 10% on last year in listings and enquiries' Martin Salmon of MGM Boats told Afloat.ie. 'We have just shy of 200 boats on the wall and the customer feedback has been excellent'.

MGM Boats have been consistent exhibitors at the UK show throughout the recession and appear to be reaping some rewards. 'There is definitely an appreciation from the public of the effort and consistency of our boat show presentations', Salmon said. 'A lot of people have remarked about the half hearted efforts of their local brokerage companies just listing on the web and sitting back waiting on the phone to ring' 'I am very confident that we will achieve multiple sales and sign up plenty of new listings as a result of this show', he added.

Kiran Haslam, Marketing Director at Princess Yachts, comments: "Fantastic feeling; the sun has been shining today, and our hospitality area as well as our yachts on display are buzzing with show visitors and invited guests. The right conversations are taking place and we are delighted with the organisation of the show this year."

Commenting on the strong retail sales figures, Sean Robertson, Sunseeker International’s Sales Director, said: “The first weekend at Southampton Boat Show has been extraordinary and we are pleased that the Manhattan 52 has commanded so much interest; testament to our substantial investment in new model development which is having broad appeal from both existing clients and customers new to the brand, keen to join the Sunseeker family. The show has predicted to attract over 110,000 people over the ten day period and we look forward to welcoming even more visitors to the stand.”

Sebastian Hirst, Head of Sales for Sunsail and The Moorings, said: “It has been a great Southampton Boat Show so far for us. We have taken more bookings so far this show than we would usually expect, with more people committing to booking here and now, rather than taking the quote and contacting us later. We are also impressed with the busy buzz about the Show and we are very happy with the new layout of Ocean Hall and our stand position – it feels much more open and welcoming.”

Paul Martin of BHG Marine, said: “The start of the Southampton Boat Show 2016 has been promising, with great interest in our new products and higher levels of interest than we anticipated. We are confident that by the end of the week the enthusiasm will continue.”

The Show opened to the British Sailing Team, including Olympic medallists, Giles Scott, Saskia Clark, Hannah Mills and Nick Dempsey alongside award-winning actress, Michelle Keegan. Gold medal winner, Giles said: “The Southampton Boat Show is a highlight on any sailor’s calendar and is a great place to spend time with family and friends. It’s something everyone should experience”.

Featuring one of Europe’s largest purpose-built marinas, the event will play host to lots more activity over the next seven days. Today, Tuesday 20 September, saw nearly 60 apprentices celebrating their graduation whilst British Marine’s new careers video was also launched on the Show’s Festival Stage powered by Datatag & the COMPASS scheme. The Show will also welcome the Rt Hon John Hayes MP, Minister of State for Transport, on Wednesday, 21 September.

Arcadia Sherpa 55 – A Glimpse at the Future of Motorboat Design?

What about this for a day cruiser, a shadow boat, a support vessel or even as a fishing boat? The Italian built Arcadia Sherpa 55 from Naples has an extremely short foredeck and expansive cockpit behind the superstructures. The most striking feature is its tug–style bow extending up to the upper deck.

The first of these boats for sale came with two spacious cabins, although three will be possible on future models. From the deck saloon there is a magnificent view through the large windows to aft over the cockpit that is located a level above the 13 m² tender garage. The flybridge with its breezy outside helm station can be fully enclosed with windows, be it to defy inclement weather or to provide protection from heat with the aid of the air conditioner.

Two Volvo Penta IPS 600 drives deliver a top speed of 25 knots.