Displaying items by tag: Maritime Economist

Irish Maritime Transport Economist Report Reveals One of the Most Challenging Years In Decades

The Irish Maritime Development Office (IMDO) has announced the publication of the 18th edition of the Irish Maritime Transport Economist.

In this edition, we report on 2020, one of the most challenging years that the Irish maritime industry has faced for many decades.

The outbreak of COVID-19 in Q1 had a dramatic and negative effect on freight and passenger volumes. Public health concerns necessitated the imposition of restrictions on the movement of people, internationally and domestically.

In the early months of the pandemic, passenger volumes fell by over 90%, while RoRo freight volumes fell by over 25%. Although other shipping market segments were not immune to the suppressive economic effects of the public health restrictions, their impacts were not as deep or as lasting as those experienced in the RoRo freight and passenger segments.

The second half of 2020 stands in marked contrast to the first half, from a RoRo and LoLo freight perspective. The losses of the first half of the year were recovered, as initial public health restrictions were eased and most retail activity recommenced in Q3.

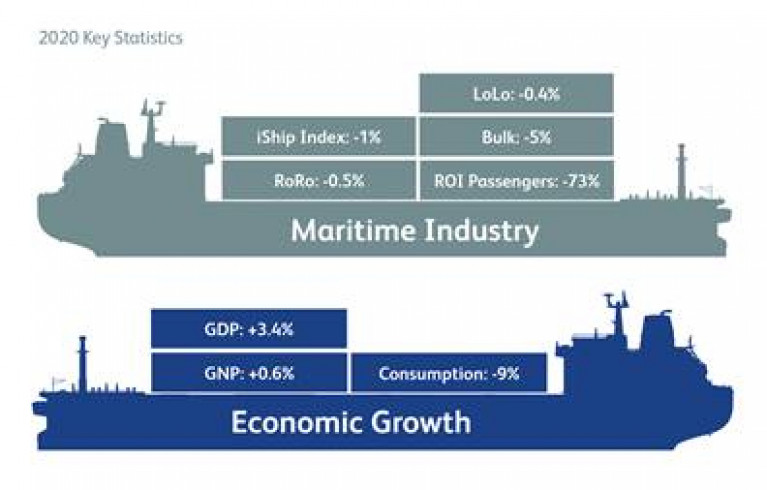

Moving through Q4, combined RoRo and LoLo freight volumes set a new record of 1,324 points on the IMDO’s iShip Index for unitised trade. Unitised volumes were bolstered by the desire of traders to create stockpiles in advance of the year-end Brexit deadline. RoRo and LoLo volumes in Q4 were sufficient to make good earlier losses and bring overall unitised throughput for the year to just 1% below 2019 levels.

The restrictions on international travel introduced in Q1 remained in place, resulting in passenger volumes falling by 73% for the year. Bulk trades were also negatively affected by lockdown measures. Market demand for bulk materials, particularly in the construction and transport sectors, fell significantly.

The COVID-19 pandemic and preparations for Brexit placed unprecedented pressure on the maritime industry in 2020. The response of the industry to the COVID-19 outbreak has been remarkable, from both an operational and a health and safety perspective.

Connectivity to international markets was maintained, supply chains were protected and measures were put in place to protect the health and safety of users of (Irish) ports and shipping services. All of this was achieved while preparations ramped up for the UK’s departure from the EU, the result of which involves a new regime of border controls and inspections in our ports. This work was undertaken with commitment and professionalism by all workers in our maritime industry, who are deserving of our thanks and admiration.

In conclusion, may I take this opportunity to wish all those involved in the maritime transport sector success in the vitally important work they do in maintaining and expanding Ireland’s trade links with the rest of the world and in driving growth, efficiency and competitiveness in our economy.

The effects of COVID 19 continue to be felt in the maritime industry, but the resilience that the industry has demonstrated in recent times and the growing success of the Government’s vaccination programme, give cause for optimism in the industry’s to bounce back and contribute to the recovery the Irish economy.