Displaying items by tag: Fleetwood

Service to Fleetwood 'Not a Viable Option' for Manx Operator

Issues of silting at Heysham Port in England, is a regular issue for the Isle of Man ferry the Ben-my-Chree.

It's unlikely sailing to Fleetwood rather than Heysham would solve the silt problems the Isle of Man Steam Packet Company faces when sailing to Lancashire.

That's from pilot and former Douglas South MHK Paul Quine.

The ferry operator's managing director recently said silting remains a problem for the Ben-my-Chree when entering Heysham.

But Mr Quine believes that issue isn't unique to Heysham.

In addition to Manx Radio's report, scroll down the page to a podcast on the matter.

Farewell to Former B+I Line Freight-Ferry

This will enable P&O to offer up to three Ro-Pax style sailings a day on the 7.5 hour route instead of the previous two-plus one ro-ro (freight-only operated) service. The Norcape could take 125 drop trailers but only had 12-passenger cabins (for freight accompanied truck-drivers).

Norcape was only re-introduced onto the Irish Sea last year but made her final departure tonight as the vessel headed into a foggy Dublin Bay.

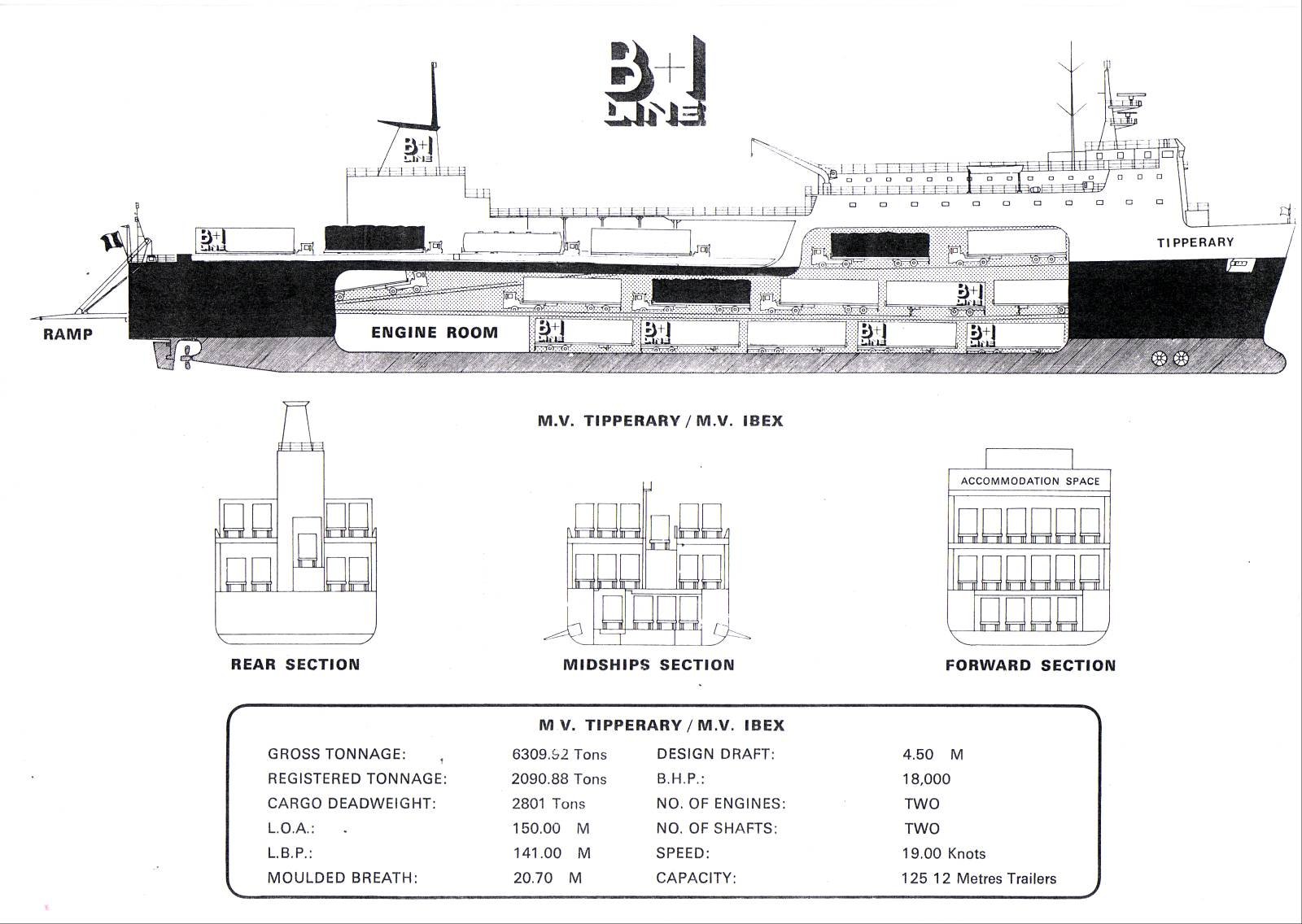

In 1979 the Japanese built vessel was launched as the Puma for P&O but was chartered to B+I Line and renamed Tipperary. During the 1980's the vessel first operated a then new Dublin-Fleetwood route jointly operated with P&O, alongside Tipperary's Ro-Ro sister, Ibex. The P&O brand name Pandoro cleverly stood for P and O Ro, their roll-on roll-off freight division.

Cut-away deck profile of M.V. Tipperary and sistership of M.V. Ibex

The route's UK port switched to Liverpool in 1988 with Tipperary remaining on the route until sold to North Sea Ferries in 1989 and renamed Norcape. Prior to her transfer to the North Sea, the Tipperary collided with the 4,674grt bulker Sumburgh Head off the entrance to Dublin Port on 18 February 1988. For a report and photo taken of the two vessels which met at the port last year under different names click here.

Like the Tipperary the Sumburgh Head was built in Japan too by Hashihama Zosen KK, Imabari in 1977, yard no. 624. During her Dublin Bay incident, the vessel was owned by Christian Salvesen (Shipping) Ltd based in Edinburgh.

In 1990 she was sold to Barra Head Shipping Ltd and renamed Hood Head under the Irish flag. Three years later sold again to the KG Jebsen group and renamed Husnes.

The Panamanian flagged bulker remained with the Norwegian owner until 2003 when sold to her current owners, Wilson Shipowning AS of Bergen and renamed Wilson Tana, this time under the Maltese flag.

Ferry-Fallout as DFDS Exit Irish Sea

The routes represented a fifth of the freight market and will result in the withdrawal of the twin 21,856grt passenger ferry (ro-pax) sisters, Dublin Viking and Liverpool Viking on the 7-hour Mersey route and the 13,000grt freighter Anglia Seaways on the route to Lancashire.

In recent years, new tonnage notably in the form of four freight-only newbuilds commissioned for Seatruck Ferries on their Warrenpoint-Heysham and Dublin-Liverpool routes has added to intense competition in a crowded north Irish Sea ferry-freight sector.

The process to purchase Norfolkline's Irish Sea operations by DFDS Seaways was finally completed in mid-summer of last year. The acquisition saw the Scandinavian newcomer take control of four routes between Birkenhead-Belfast / Dublin and the freight-only Heysham-Belfast / Dublin services and a fleet of seven vessels, four (ro-pax) ferries and three freight-only vessels.

DFDS Seaways latest decision is all the more dramatic as the company in early December then sold both Belfast routes to Birkenhead and Heysham to Stena Line. In addition the £40m acquisition included the sale of the chartered 27,510 ro-pax sisters Lagan Seaways and Mersey Seaways and the 13,000grt freighter half-sisters, Scotia Seaways and Hibernia Seaways. The deal is significant in that Stena will make an inaugural foothold on the Merseyside market.

With the sea-changes swirling in the Irish Sea market, the dominant player is with out doubt Stena Line. The ferry operator closed late last year the Larne-Fleetwood route and three vessels (for more information about those vessels click here) yet the inclusion of the former DFDS Belfast-Heysham route is closely similar with neighbouring ports and newer larger vessels.

The acquisition by Stena of the loss making routes from DFDS last month also coincided with a review to be conducted by the Danish companies remaining Dublin routes to Birkenhead and Heysham. The findings of that review were concluded with this months' decision by DFDS to close down the routes, marking the Scandinavians operators brief foray on the Irish Sea ferry scene.

Stena Route To Close This Week

The Stena Leader went to lay-up in Belfast. In the meantime the remaining vessels Stena Seafarer and Stena Pioneer continue to serve the Northern Ireland-Lancashire link.When the route closes, it is expected that the pair will re-join the Stena Leader in Belfast, where all three sisters will be at lay-up berth at Albert Quay. The Swedish owned ferry operator uses the port's Victoria Terminal 4, for their HSS and conventional ferry service to Stranrear, Scotland.

In early December Stena Line announced the acquisition of two routes and four vessels from rivals, DFDS Seaways. The £40m deal sees Stena taking over the freight-only route between Belfast and Heysham operated by Scotia Seaways and Hibernia Seaways, a pair of Japanese built 13,000 gross tonnes vessels.

The second route is the Belfast-Birkenhead (Liverpool) route, served by two chartered 27,000 gross tonnes ro-pax sisters, Lagan Seaways and Mersey Seaways. The ro-pax vessels will be sold to Stena Line as part of the agreement between the two ferry operators.

Stena to Close Larne-Fleetwood Route

The route has made significant losses over recent years and to running an aging fleet on the 7-hour service. Stena cite that investment in new tonnage was not an option due to higher capitol costs. "No business can continue to carry such losses on an ongoing basis so there is no alternative but to close the route at the end of this year," he added.

The trio of vessels, Stena Leader (1975/12,879grt), Stena Pioneer (1975/14,426grt) and Stena Seafarer (1975/10,957grt) serve the link between Lancashire and Northern Ireland which takes freight, cars and their passengers but does not cater for 'foot' passengers.

Late last month a fire took place in the engine room of the Stena Pioneer during a sailing to Fleetwood, the fire was extinguished using onboard equipment and fortunately without incident to crew or passengers.The Stena Pioneer was operated by B&I Line as their Bison in a joint service with Pandoro on the Dublin-Liverpool route between 1989-1993.

Under the new agreement, Stena Line's take-over of Belfast-Heysham, the port is a close neighbour to Fleetwood will include the 13,000 tonnes sisters Hibernia Seaways and Scotia Seaways.The other route aquired is Belfast-Birkenhead (Liverpool) which is significant in that the deal will include the purchase of the chartered 27,000 gross tonnes ro-pax twins, Mersey Seaways and Lagan Seaways. The sisters were built in 2005 at the Visentini shipyard, Italy, which also built the ro-pax sisters Dublin Seaways and Liverpool Seaways.

Measuring 21,000 gross tonnes these vessels operate Dublin-Birkenhead route but remain under DFDS Seaways control and this applies to their freight-only service from the Irish capital to Heysham served by the Anglia Seaways. The 120-trailer freight ferry is also a sister of the Belfast-Heysham pair.

Notably the transaction will see Stena Line enter operations on the Mersey for the first time.The Swedish operator will use the river's Birkenhead Twelve Quays ferryport terminal located on the Wirral, opposite the famous Liverpool waterfront.

Stena Line will not only share the double berth facility with DFDS Seaways but also the Isle of Man Steam Packet (IOMSPCo) which in recent years has operated winter sailings to Douglas. In the summer the Isle of Man ferry operator uses the Liverpool landing stage berth on the other side of the river which is also shared by the 'ferry cross the Mersey' fleet operated by Mersey Ferries.

Fire on Board Stena Ferry

Two lifeboats proceeded to the Stena Pioneer this afternoon after crew on the ferry issued a mayday call reporting a fire in their engine room whilst they were on passage to Fleetwood on the Irish Sea. A helicopter was also placed on standby.

Liverpool Coastguard received the mayday at 3.36 pm and made contact with crew on board the vessel, who reported that they still had full power and steering but that there was a fire in the engine room that they were fighting with their on board fire fighting equipment.

Liverpool Coastguard sent lifeboats from Fleetwood and Barrow to the scene. The fire was reported as out at 4.30 pm and the ferry is now docked at Fleetwood.

Liverpool Coastguard Watch Manager Paul Parkes said:

"A fire on a ferry 12 miles out with 46 people on board could potentially turn into a very serious incident, and so we acted quickly to send rescue resources to its aid. Luckily, the fire was dealt with using on board equipment and so the lifeboats escorted the ferry into Fleetwood where it was met by Lancashire Fire and Rescue service and an MCA surveyor."