Displaying items by tag: Dublin Port

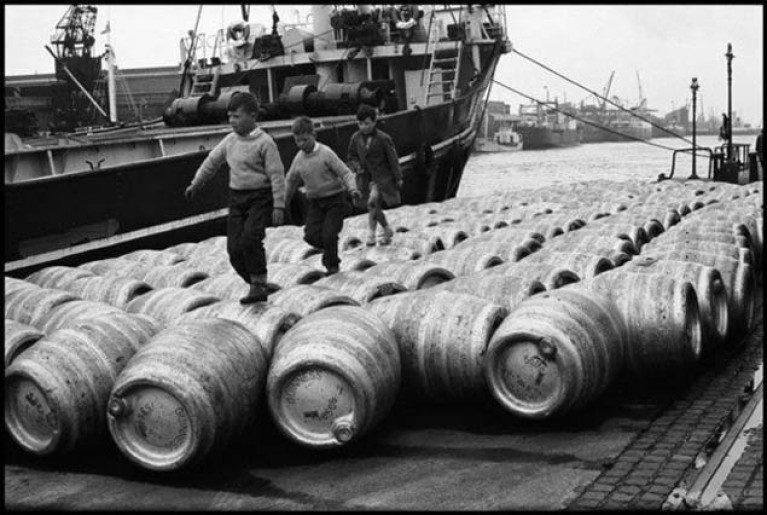

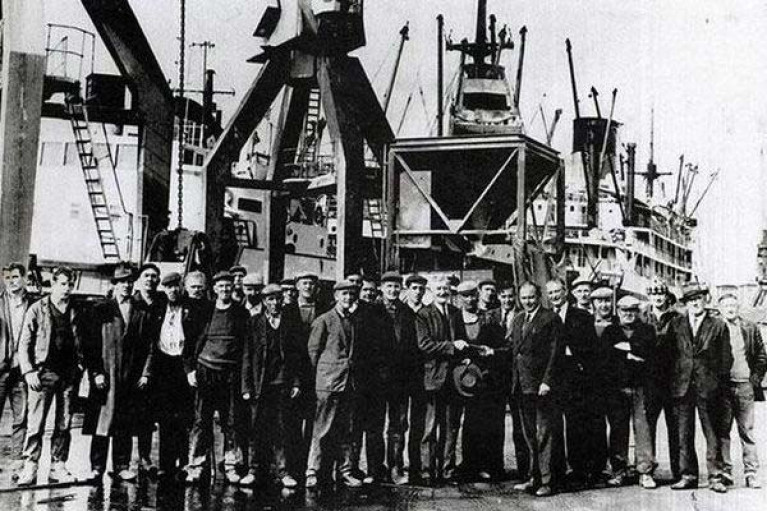

Hopes High for Dublin Dock Workers' Preservation Society Photo Archive

Good news from the Dublin Dock Workers' Preservation Society in their attempts to save their 6,000 historical photographs collection. The problem was reported earlier this week on Afloat.

Declan Byrne of the Society says: "We have been overwhelmed by the offers of help and support to preserve our archive. We are meeting up with Lar Joye Port Heritage Director of Dublin Port Company"

Hopefully, there will be a positive outcome and the important collection will be saved.

There has been 'terrible news' reported for Dublin Dock Workers' preservation society who need urgent help to preserve records stored on the internet.

The Dublin Dock Workers’ Preservation Society was set up nine years ago, in early 2011.

It is composed of ex-dock workers and people interested in preserving the history of Dublin Port. It has successfully held a number of exhibitions and raised awareness of the culture, history and tradition of Dublin Docks and Dock Workers.

It started by collecting historic photographs and has amassed a collection of 6,000 but is now in danger of losing them all and is seeking urgent help to preserve them.

Today came what one of its leaders, Declan Byrne, described as: “Terrible News.”

He said: “We have been notified that we are losing the internet site where we store our 6,000 donated photographs. We used this bluemelon site because people could download the photographs for free. We have now been told: "Your Bluemelon subscription is set to expire on 07-Feb-2020. Unfortunately, due to recent changes in the industry, we are no longer able to offer you an extension for your subscription. Your account will expire on 2020-02-08 and your files will be deleted. Thank you for the time you have spent with Bluemelon."

Declan told me: “We do not have the resources or personnel to download the photos and save them. Any help would be greatly appreciated.”

So, is there someone with the knowledge, resource, ability, to help preserve this valuable collection for the Society.

Email offers of help to Declan Byrne: [email protected]

As Storm Brendan is forecast to arrive on Monday morning, 13th January 2020, combined with a period of high tides, Dublin Port Company will temporarily close public access to the Great South Wall and the North Bull Wall Bridge on Monday from the following times:

- Great South Wall from 1100hrs - 1600hrs

- North Bull Wall Bridge from 1200hrs - 1430hrs

In Dublin on Monday there is an ORANGE wind warning in effect from 0800hrs -1500hrs.

The Marine forecast for the Irish Sea is a RED warning with strong gale force (Force 9) to storm force (Force 10). There will be heavy rain from 1200hrs - 1500hrs.

High tide at 1311hrs is predicted to reach 5.09m and Dublin City Council is activating flood defences.

The Great South Wall closure is due to tide height and dangerous winds on the exposed wall surface. The Bull Bridge closure is due to tide height.

Delays to some shipping activity is expected, including possible delays at the port’s LOLO container terminals, i.e. where containers are loaded and unloaded by crane.

With wind and rain expected until Thursday this week, Dublin Port Company will continue to monitor the situation.

Cargo Ship Loses Containers Enroute to Dublin

A cargo ship en route to Dublin Port was caught in this week's storms and lost at least 12 containers overboard.

The Maritime Bulletin reports that the ship 'Elbcarrier' lost the containers in the Celtic Sea on the afternoon of Sunday, December 8, while en route from Rotterdam to Dublin and being caught in rough seas.

The Bulletin's reporter is Erofey Schkvarkin, a Merchant Marine Captain, who also writes that 12 drifting containers were spotted at 2330 UTC in vicinity 51 40N 005 50W.

The ship reached Dublin in the afternoon Dec 9. More on this in the Maritime Bulletin here

Containers Blown Over

Separately, a reader has sent Afloat photo of containers blown over in Dublin Port in high winds this week.

Shipping containers capsized in Dublin Port this week

Shipping containers capsized in Dublin Port this week

Dublin Port: Year in Review 2019

As the main gateway for trade in and out of Ireland, 2019 has been a year of exceptional progress and growth at Dublin Port on several fronts

No. 11 Liffey Ferry returns

The start of 2019 saw the return of an old favourite on the River Liffey with the re-launch of Dublin’s original No. 11 Liffey Ferry after a 35-year absence. The much-loved ferry service had been vital in linking the North and South docks communities but was decommissioned in 1984 following the completion of the East Link Bridge. Affectionately known as ‘the dockers’ taxi’, Dublin Port Company purchased the boat in 2016 from Ringsend man and former port worker Richie Saunders. Richie had salvaged and preserved the ferry, hoping one day to see her back on the River. A joint restoration project by Dublin Port Company and Dublin City Council saw the ferry restored to her former glory and given a new lease of life. Now operated by the Irish Nautical Trust, she can be seen ferrying a new generation of passengers between the 3Arena, Sir John Rogerson’s Quay and North Wall Quay.

The much-loved No.11 Liffey Ferry service returned in 2019

The much-loved No.11 Liffey Ferry service returned in 2019

MV Laureline Sails Direct

With 8,000 ship arrivals per year, Dublin Port is a hive of activity all year round. In recent years, Ro-Ro services on direct routes between Dublin and Continental Europe (Rotterdam, Zeebrugge and Cherbourg) have commenced and large new ships such as CLdN’s MV Celine and Irish Ferries’ W.B. Yeats have been deployed. In March 2019, we welcomed the addition of CLdN’s MV Laureline, now the second biggest freight ferry to service Dublin Port and a sister ship of the Brexit Buster MV Celine. Her first departure from Dublin Port coincided with “Brexit Day”, the original date of March 29th when the UK was expected to exit the European Union.

CLdN’s MV Laureline, now the second-biggest freight ferry to service Dublin Port and a sister ship of the Brexit Buster MV Celine

CLdN’s MV Laureline, now the second-biggest freight ferry to service Dublin Port and a sister ship of the Brexit Buster MV Celine

Brexit

Preparations for Brexit continued during the year, with Dublin Port providing the lands and infrastructure required by State Agencies for primary and secondary border inspection posts. Combined, the new set of inspection facilities spans almost 8 hectares of land within the port estate and follows a €30 million investment by Dublin Port Company in both the construction and the acquisition of assets to facilitate this.

The MP2 Project will involve development works within existing port lands

The MP2 Project will involve development works within existing port lands

Future of Cruise Tourism

It is within the context of the ABR Project that the company has launched a public consultation on the future of cruise tourism at Dublin Port, seeking the views of stakeholders as to the appetite of the City for large-scale cruise tourism; as well as environmental considerations, specifically air emissions and the financial challenge of funding the proposed new cruise berths. During the year, it was also announced that the port would temporarily limit the number of cruise ships calling at Dublin Port to approximately 80 for the period 2021 – 2023 in order to facilitate works on Alexandra Basin.

Treading the Boards

The company’s arts commissioning programme Port Perspectives celebrated life in the port and docklands communities with a Year of Theatre, which saw three Irish theatre companies commissioned to create original plays. Audiences came from far and near to see In Our Veins by Lee Coffey, a co-production between Bitter Like A Lemon and the Abbey Theatre, What Lies Beneath - Port Stories by The Lir Academy and Ringsend College, and Last Orders at the Dockside, an Abbey Theatre production by acclaimed playwright Dermot Bolger.

St Patrick’s Rowing Club Regatta

St Patrick’s Rowing Club Regatta

Life on the River

During the year, the River Liffey was home to a host of events supported by Dublin Port Company including the Poolbeg Yacht Club Regatta, Clontarf Yacht Club Regatta, East Wall Water Sports Regatta, All in a Row charity event, Dublin Currach Regatta, St. Patrick’s Rowing Club Regatta, Stella Maris Rowing Club Regatta, the Hope Row, the “Three Bridges” Liffey Cruise and the Liffey Swim. These important events in the local sailing calendar provide an opportunity for local communities to come together and celebrate life on the River Liffey in all its forms.

Majestic Tall Ships on the Liffey

Majestic Tall Ships on the Liffey

History in the Making

Historical maps, engineering drawings and photographs continue to emerge and be displayed online as the Port Heritage team progresses with the digitisation of thousands of images from Dublin Port’s 300-year-old archive. The material gives a fascinating insight into life at the port down through the ages and has proven invaluable to a host of local history events, talks, tours and evenings this year, including an exhibition celebrating the Bicentenary of Bullock Harbour, organised by the Dublin Port Archive in association with Bullock Harbour Preservation Association and dlr LexIcon.

New Pilot Boat Arrives into Dublin Port

Dublin Port Company’s new Pilot Boat named DPC Tolka has arrived into Dublin Port at the weekend.

The state-of-the-art vessel will allow marine pilots to reach and board larger ships in all weather conditions from a greater distance out into Dublin Bay.

As Afloat reported last September, the leading UK boat builder Goodchild Marine Services Limited secured the contract to construct the new Boat.

The new 17.1 metre ORC vessel (originally expected to be delivered in July) is the first Pilot Boat for export by Norfolk-based Goodchild Marine Services Limited.

The boat is renowned for its fuel efficiency, capacity to cut emissions and ability to handle high speeds in bad weather owing to an innovative beak bow design which can steady the hull of the boat as it pitches into the sea.

Piloting the new vessel on her maiden voyage to Dublin was Alan Goodchild of the leading UK boat builder Goodchild Marine Services Limited, the Norfolk-based company that built DPC Tolka having secured the contract to construct the boat in 2018.

Taking delivery in Dublin Port was Harbour Master Captain Michael McKenna and Assistant Harbour Master Tristan Murphy. The new addition to the port’s fleet of working vessels, which includes tug boats Shackleton and Beaufort, multi-purpose workboat the Rosbeg, and pilot boats Liffey and Camac will replace the oldest pilot boat Dodder, which now retires from service after 23 years.

Designed by French Naval Architect Pantocarene for both fuel efficiency and performance in challenging weather conditions, DPC Tolka features the latest navigational and safety equipment on board, including a dedicated Pilot workstation in the wheelhouse and hydraulic Man Overboard Recovery Platform at the stern.

With shipping companies increasingly deploying longer, deeper ships capable of carrying more cargo, DPC Tolka represents a vital upgrade in the provision of pilotage services at the Port and will allow Dublin Port’s team of highly skilled marine pilots to reach and board these ships in all weather conditions from a greater distance out into Dublin Bay.

Dublin Port Harbour Master, Captain Michael McKenna, said: “Dublin Port Company is delighted to take delivery of DPC Tolka, and we’ve already started training our pilots and pilot boat teams on the workings of the new vessel ahead of entering service in the coming weeks. Demand for pilotage continues to grow as more and more ships service Dublin Port, and DPC Tolka will help meet the operational and navigational needs of both regular customers and visiting vessels in the years ahead. Our thanks to the crew at Goodchild Marine for their skills and workmanship in designing and delivering this vessel.”

Eamonn O’Reilly, Chief Executive, Dublin Port Company, said: “Investment in infrastructure is not simply confined to marine engineering works such as building quay walls, but also extends to the fleet that keeps the Port operational around the clock. Our pilots increasingly need to embark and disembark from much larger capacity ships, often in poor weather conditions or at peak times when demands for pilotage services are highest. DPC Tolka has allowed us to upgrade our equipment in line with customer investment in new ships and additional capacity on existing routes.”

Alan Goodchild, Managing Director, Goodchild Marine, said: “Our flagship ORC range of pilot boats are certainly making waves within the industry and we are delighted to be able to export our first ORC 171 to the Dublin Port Company.

“The pilot operation across the UK and Europe now demands bigger and stronger boats that can withstand the most challenging conditions. We believe we have responded to market demand by producing such a vessel.”

Steve Pierce, General Manager, Goodchild Marine said: “It is very important for us to consider the impact that our boats make, both financially and environmentally. Our ORCs are becoming renowned for cutting fuel emissions, with customers reporting fuel savings of up to 40% a year, which we hope is an incentive for both existing and potential clients.”

Officers from Argentinian Navy in Mayo Honour Founder Admiral Brown

Around 200 Argentinian military personnel reports RTE, travelled to Co Mayo to visit the town where the founder of the country's Navy was born.

Admiral William Brown hailed from Foxford and today’s (yesterday) trip was the largest to take place by officers from the Navy he led.

The visiting party was joined by members of the Irish Naval Service for the ceremonies.

The event also attracted many Argentinians living in Ireland, keen to meet up with their compatriots.

The Naval officers attended a memorial mass in the local church before continuing a parade through the town.

As Afloat previously reported the ARA Libertad is the sail training vessel of the Argentinian Navy which visited Dublin Port at the weekend. The five-day visit ends tomorrow afternoon.

More here on the visit to Foxford.

A winter night's gathering in the familiar setting of Poolbeg Yacht & Boat Club in Ringsend in the heart of maritime Dublin can make it seem like summer again for a few magic hours, and this year’s programme, put together by Talks Organiser Darryl Hughes of the classic gaff ketch Maybird, is setting the bar high for his successors.

He has persuaded a varied, entertaining, informative and knowledgeable selection of five speakers to provide four shows, and it starts with renowned local and marine historian Cormac Lowth giving an impressive presentation on Dublin Port on Thursday, November 14th, and concludes with the historic Ilen Project’s Salmons Wake Voyage to West Greenland by Gary MacMahon on Thursday 19th March.

Views of the public, businesses and other interested parties is been sought from Dublin Port Company, on the benefits of investing €108 million in terminal facilities to attract more cruise ships, writes The Irish Times.

The semi-State company (yesterday) launched a public consultation on the future of cruise tourism, seeking opinions on the appetite in the city for his large-scale tourism business, managing the increase in air emissions from additional cruise ships and the financial challenge of funding the proposed new berths.

Economic consultants Indecon estimate the €108 million spent on new berths at the port’s North Wall Quay extension between 2024 and 2026 could generate a net economic benefit of €211 million based on 2019 values.

The port company, however, has said it cannot finance the project itself given its €1 billion plan to build extra capacity to accommodate the projected growth of cargo up to the year 2040.

The proposed new berths would be of limited alternative use outside of cruise ships such as for generating revenue for cargo operations, the company said.

Click here for more on the story.

Cruise Tourism in Dublin Port: Public Consultation Opens

Dublin Port Company (DPC) has launched a public consultation on the future of cruise liner tourism at Dublin Port. To help inform the consultation process, DPC has published a discussion paper setting out key considerations to be addressed. DPC has also published the findings of an independent economic cost-benefit analysis by Indecon International Economic Consultants and recent research by Fáilte Ireland on expenditure by cruise tourists in Dublin.

The consultation, which opens today and runs until 17th January 2020, seeks the views of stakeholders on the future development of cruise tourism in Dublin regarding a number of issues, including:

- The appetite of the City of Dublin for large-scale cruise tourism;

- Environmental considerations, specifically air emissions;

- The financial challenge of funding proposed new cruise berths.

The context for the consultation is Dublin Port’s Alexandra Basin Redevelopment (ABR) Project, which is currently under construction. The final part of this project will involve building new berths suitable for the largest cruise ships at North Wall Quay Extension, east of the Tom Clarke Bridge. Construction is scheduled to start in 2024, meaning the new berths would be available for the cruise season of 2026.

Widespread Support a Prerequisite

DPC is first and foremost looking to ascertain the level of broad-based appropriate support as a prerequisite for the proposed development. The key question being asked of stakeholders, including the general public, is whether Dublin wants to have a large-scale cruise tourism business. If so, then the proposed berths at North Wall Quay Extension are needed.

Air Emissions

Any new berths that might be constructed will have provision for shore power and cruise ships would be required to turn off their engines and use this shore power while at berth. This mandatory requirement is particularly important given the challenge facing the City to address likely imminent breaches of EU air quality limits. DPC wishes to establish the willingness and ability of cruise lines to meet this requirement in Dublin in the future if the new berths are constructed.

Investment Required

The investment required to construct the new berths at North Wall Quay Extension is estimated at €108 million, excluding terminal facilities for cruise turnarounds. Dublin Port Company projects that this investment could treble the number of cruise tourists to 619,000 by 2040, with approximately one-third of these being turnaround passengers who start and finish their cruise in Dublin. By way of context, Dublin Port received some 197,000 cruise tourists in 2018, and approximately one-fifth were turnaround passengers.

Indecon Report

DPC commissioned Indecon International Economic Consultants to evaluate the economic benefit from the proposed investment and from the projected increase in cruise tourism. Indecon’s key finding is that the economic return would be positive. Indecon estimates that the investment of

€108 million (over the years 2024 to 2026) would generate a net economic benefit of €211 million (at 2019 values), equivalent to a benefit to cost ratio of 2.83.

However, the scale of the investment required and the level of risk are such that DPC could not itself finance the project. The company is currently implementing a €1 billion ten-year capital investment programme to deliver additional capacity to cater for projected cargo growth up to 2040. From a development risk perspective, the proposed new berths would be of limited alternative use outside of cruise, i.e. for revenue-generating cargo operations.

Co-Financing Arrangement

Therefore, if the project is to proceed, co-financing is required (as outlined in Masterplan 2020 – Reviewed 2018, Page 33). This could involve a concession agreement with a private sector operator or operators which would provide the €108 million funding up front in exchange for the right to operate the facility for a defined period. Such an approach is provided for in National Ports Policy. Based on the Indecon analysis, DPC is seeking to establish the level of interest among cruise companies and others to support the required investment and arrangement.

Eamonn O’Reilly, Chief Executive, Dublin Port Company, said: “The first part of this consultation asks whether Dublin wants a large cruise tourism business or not. We need to know that there is widespread support and a genuine desire to see cruise tourism on a significantly larger scale than ever before if we are to proceed to build new berths as far upriver as the Tom Clarke Bridge capable of accommodating the largest cruise ships two at a time.

“The second aspect of the consultation looks at how the construction of new cruise berths at

North Wall Quay Extension can be financed. With the Indecon analysis complete, we are clear about the economic benefits of any such investment, but unclear about the industry’s willingness to co-finance future development. This consultation provides an important opportunity to engage and we welcome responses from all stakeholders, national and international, to the process.”

Submissions

Interested parties are invited to respond to the consultation document (available to download at https://www.dublinport.ie/masterplan/cruise-consultation/ no later than 17th January 2020, either by email to [email protected] or by post to:

Cruise Consultation, Dublin Port Company, Port Centre, Alexandra Road, Dublin 1.