Displaying items by tag: European Endeavour

Ferry For Falmouth

#FERRY NEWS – European Endeavour (2000/ 24,046grt), the largest of three ferries running for P&O's Dublin-Liverpool route departed from the capital's port this afternoon bound for A&P Groups dry-dock facility in Falmouth, writes Jehan Ashmore.

The former Dover-Calais serving ferry started working on the Irish Sea on a full-time basis last year as previously reported. Her fleetmates are the 17,000 tonnes sisters Norbank and Norbay.

The trio of ro-pax ferries are to a design where freight is predominately the main cargo and passenger capacity is reduced considerably compared to most conventional ferries. European Endeavour can handle 130 lorries and accommodate 210 passengers whereas her fleetmates are the reverse with greater freight capacity for 150 freight units and a reduced capacity for 114 passengers.

P&O are the only ferry firm on the route providing passenger and car ferry service though they do not cater for 'foot' passengers. Their rivals Seatruck Ferries offer the only dedicated freight-operation on a network of routes on the north Irish Sea including the Liffey-Mersey link, where in recent months new tonnage has entered service.

Former B+I Line Freight-Ferry Bound for Turkish Breakers

#FERRY NEWS-P&O Irish Sea's Larne-Troon freight-ferry Norcape (14,087grt) departed the Co. Antrim port last week to be broken-up at ship-breakers in Aliaga, Turkey. She originally served B+I Line as the Tipperary, but her last sailings took place on the North Channel in late November, as the ageing vessel is in her fourth decade of service, writes Jehan Ashmore.

The 125-trailer capacity ro-ro was not replaced on the single-ship operated route which closed for the winter months, though sailings will resume next March by the 92m fast-ferry Express. In the meantime freight traffic will be accommodated on the companies Larne-Cairnryan service.

Yesterday morning Norcape transitted the Strait of Gibraltar having called en-route to Falmouth several days previously. She represented the last vessel to serve in Irish waters with a direct link to B+I Line, the state-owned operator which was sold in 1992 to ICG, parent company of Irish Ferries.

When she arrives in Aliagra, this is where her former P&O fleetmate European Mariner (5,897grt) was scrapped after also serving Larne-Troon sailings until last July. Norcape entered the North Channel route replacing the smaller 53-trailer capacity vessel.

Prior to then Norcape had been in laid-over in Liverpool docks when European Endeavour replaced her in February on the Dublin-Liverpool route. To read more click HERE.

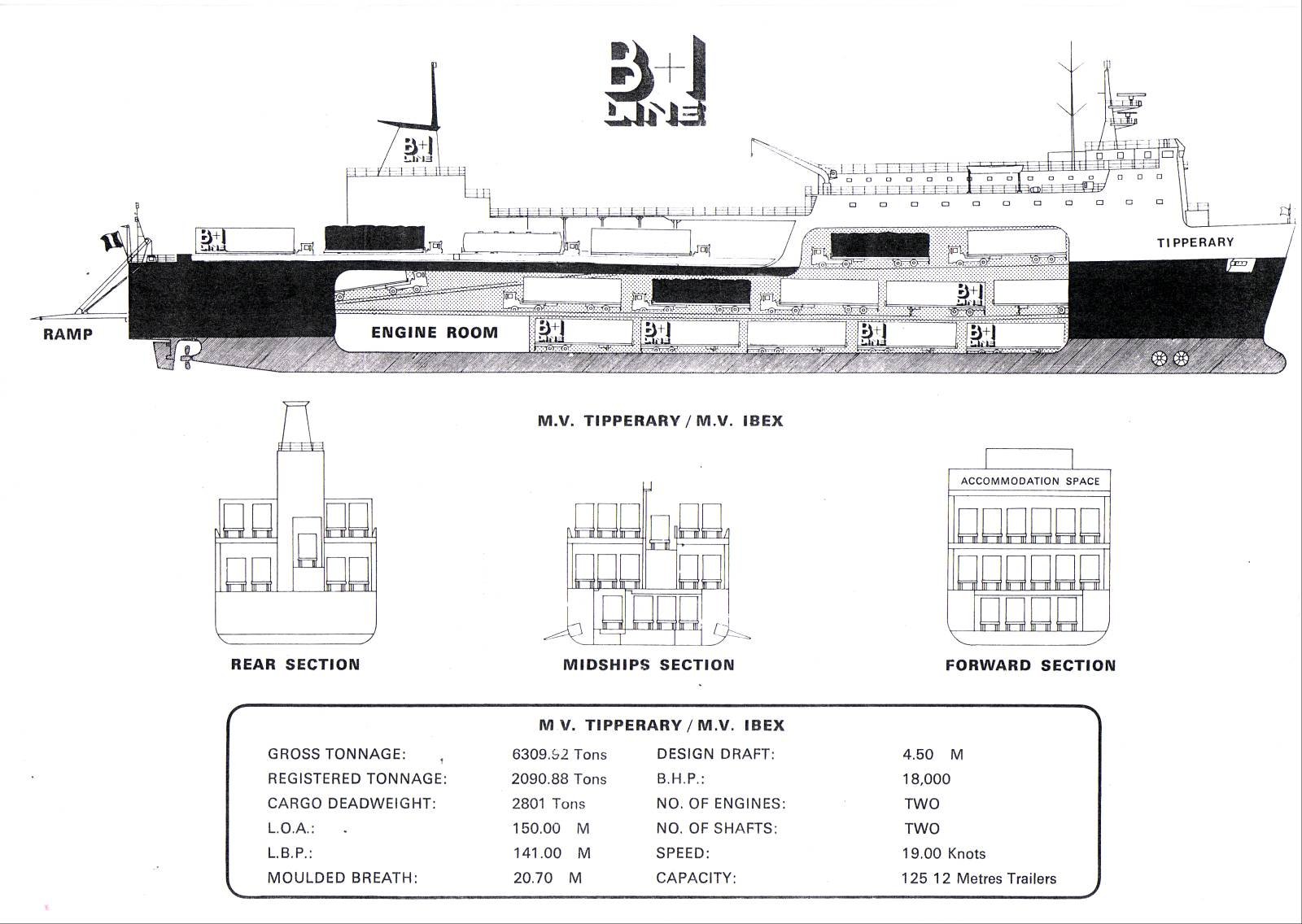

Norcape's return to the Irish Sea service in 2009, reflected her original career for P&O. She was named Puma in 1979 from the Japanese shipyard at the Mitsui Engineering & SB Co Ltd, Tamano, however she was chartered to B+I Line and renamed Tipperary. To read more and to view a deck-drawing profile, click HERE.

Her career started with a new Dublin-Fleetwood route jointly operated with P&O, who contributed with a sister, the Ibex. The P&O brand name Pandoro stood for P and O Ro, their roll-on roll-off freight division. The route's UK port switched to Liverpool in 1988 with Tipperary remaining on the route until sold to North Sea Ferries in 1989 and renamed Norcape.

Before her transfer to the North Sea, Tipperary collided with the 4,674grt bulker Sumburgh Head off the entrance to Dublin Port in 1988. Incidentally the two vessels, under different names and ownership were in Dublin Port in 2010, as previously reported (with photo) click HERE.

- Ports and Shipping News

- Norcape

- P&O (Irish Sea)

- B+I Line

- European Endeavour

- Ferry news

- Irish Sea Ferries

- Irish Sea ferry news

- LarneTroon

- MV Tipperary

- Turkish shipbreakers

- P&O Express

- MV Ibex

- Pandoro

- Aliagra,Turkey

- MV Norcape

- ICG

- ICG Group

- Irish Continental Line

- North Channel ferry routes

- LarneCairnryan

- Irish Ferries

Prior to her arrival on the North Channel, Norcape had been laid-up in Liverpool since February 2010 after the former B+I Line vessel (MV Tipperary) was replaced by European Endeavour on the central corridor route to Dublin. As of this week the ro-pax freight vessel which has been running in a freight-only mode will now carry motorists likewise to her route fleetmates Norbank and Norbay.

With the departure of European Mariner from the Irish Sea, she follows a trio of former Stena Line freight-ferry sisters which were made redundant since the closure of the Belfast-Heysham route late last year. It is believed the sisters Stena Seafarer, Stena Leader and Stena Pioneer have been sold to Russian interests to serve in the Black Sea in connection to the 2014 Winter Olympics in Sochi.

The sisters were renamed, Stena Pioneer became Ant 1, Stena Seafarer is the Ant 2 and Stena Leader is the Anna Marine. They departed Belfast Lough in mid-June to Sevastopol in the Ukraine under the Moldovan flag and with a port of registry in Giurgiulesti.

- Port of Larne

- Belfast Lough

- Stena Line

- Ports and Shipping News

- RoPax

- North Channel

- P&O (Irish Sea)

- B+I Line

- European Endeavour

- Ferry news

- Belfast Lough News

- RosslareFishguard

- LarneTroon

- European Mariner

- Freightferries

- MV Tipperary

- Central Coridoor route

- BelfastFleetwood

- Stena Europe ferry

- 2014 Winter Olympics

- Sochi

- Black Sea

- Turkish shipbreakers

- Izmir

- Turkey

- Winter Olympics 2014

- Irish Sea ferry motorists

Irish Sea 'Racehorse' Returns

Dawn Merchant and Brave Merchant represented the first pair of the 'Racehorse' class quartet of ro-pax sisters commissioned for the Cenargo Group. The quartet were built by Spainish shipbuilders Astilleros Espanoles SA in Seville, noting the first pair at 22,046grt where slightly smaller in tonnage terms compared to their 22,215grt counterparts Midnight Merchant and Northern Merchant. Upon delivery in 2000 the second pair were chartered to Norfolkline's Dover-Dunkerque route.

With a 130 truck capacity the Norman Trader can handle a marginally higher number of freight vehicles compared to the Norcape which handled 127 trucks. The Norcape, a 32-year-old freight-only vessel,was stood down in February and remains laid-up at Liverpool's Huskisson Dock. Incidentally, Norman Trader has joined one of her Racehorse class sisters, European Endeavour (formerly Midnight Merchant) which had directly replaced the Norcape on the central corridor route.

Likewise the European Endeavour is no stranger to the Irish route as for the last two years she has acted as winter relief vessel to cover the refits of the routes Dutch built ro-pax sisters Norbay and Norbank. The latter vessel is now undergoing a refit by Cammell Laird Shiprepairers in Birkenhead, now that the Norman Trader is in service to maintain the three-ship operated 8-hour route.

The Norman Trader had arrived into Dublin Bay last Friday from London's Tilbury Docks, on the next day she entered Dublin Port. In recent years she has operated on English Channel routes for the French shipping giant Louis-Dreyfus Armateurs through their ferry division LD Lines.

Norman Trader's (Dawn Merchant) sister Brave Merchant now renamed Norman Bridge also runs for LD Lines 'Motorways of the Seas' (MOS) route across the Bay of Biscay between Nantes /St. Nazaire to Gijón in northern Spain. The 14-hour route which started last year, which was run iniatially as a joint venture between Grimaldi Lines and Louis-Dreyfus and traded as GLD Atlantique.

- Dublin Port

- Bay of Biscay

- irish sea

- Ports and Shipping News

- Birkenhead

- Norcape

- RoPax

- DublinLiverpool

- Norfolkline

- FreightFerry

- Motorways of the Sea

- Norbank

- Norbay

- MOS

- European Endeavour

- Central Corridor

- P&O Irish Sea

- Norman Trader

- LD Lines

- Merchant Ferries

- Cenargo Group

- RaceHorse Class

- Tilbury Docks

- Cammell Laird

- Aintree

- Grand National

- Aintree Grand National

Enter European Endeavour

The European Endeavour will enable P&O to offer up to three Ro-Pax style sailings a day on the 7.5 hour route instead of the previous two-plus one Ro-Ro (freight-only operated) service. The 180m vessel is no newcomer on the route as over the last two years the ship has deputised to cover the annual overhauls of the routes' vessels.

The Spanish built vessel directly replaced the Ro-Ro freight ferry Norcape, which made her final sailing on the central corridor route, with the 1979 built vessel berthing at Liverpool's Huskisson Dock in the early hours of Sunday morning. Norcape could take 125 drop trailers but only had 12-passengers cabins (for freight accompanied truck-drivers).

Only last year the Japanese built vessel returned to the Irish Sea route as the Norcape but originally started a career with the B+I Line as their Tipperary on the Dublin –Fleetwood route. The UK port was switched to Liverpool in 1988, in the following year she was sold to North Sea Ferries.

The standing down of the Norcape represents the last vessel of the former B+I Line fleet to have any association with the Irish Sea. In 1991 the Irish state owned shipping company was sold to Irish Continental Group (ICG) which is a parent company of Irish Ferries. At that stage Irish Ferries operated only on the continental routes to France.

To read more about Norcape's final sailing on the Irish Sea route, click here.

Farewell to Former B+I Line Freight-Ferry

This will enable P&O to offer up to three Ro-Pax style sailings a day on the 7.5 hour route instead of the previous two-plus one ro-ro (freight-only operated) service. The Norcape could take 125 drop trailers but only had 12-passenger cabins (for freight accompanied truck-drivers).

Norcape was only re-introduced onto the Irish Sea last year but made her final departure tonight as the vessel headed into a foggy Dublin Bay.

In 1979 the Japanese built vessel was launched as the Puma for P&O but was chartered to B+I Line and renamed Tipperary. During the 1980's the vessel first operated a then new Dublin-Fleetwood route jointly operated with P&O, alongside Tipperary's Ro-Ro sister, Ibex. The P&O brand name Pandoro cleverly stood for P and O Ro, their roll-on roll-off freight division.

Cut-away deck profile of M.V. Tipperary and sistership of M.V. Ibex

The route's UK port switched to Liverpool in 1988 with Tipperary remaining on the route until sold to North Sea Ferries in 1989 and renamed Norcape. Prior to her transfer to the North Sea, the Tipperary collided with the 4,674grt bulker Sumburgh Head off the entrance to Dublin Port on 18 February 1988. For a report and photo taken of the two vessels which met at the port last year under different names click here.

Like the Tipperary the Sumburgh Head was built in Japan too by Hashihama Zosen KK, Imabari in 1977, yard no. 624. During her Dublin Bay incident, the vessel was owned by Christian Salvesen (Shipping) Ltd based in Edinburgh.

In 1990 she was sold to Barra Head Shipping Ltd and renamed Hood Head under the Irish flag. Three years later sold again to the KG Jebsen group and renamed Husnes.

The Panamanian flagged bulker remained with the Norwegian owner until 2003 when sold to her current owners, Wilson Shipowning AS of Bergen and renamed Wilson Tana, this time under the Maltese flag.