Displaying items by tag: George’s Dock

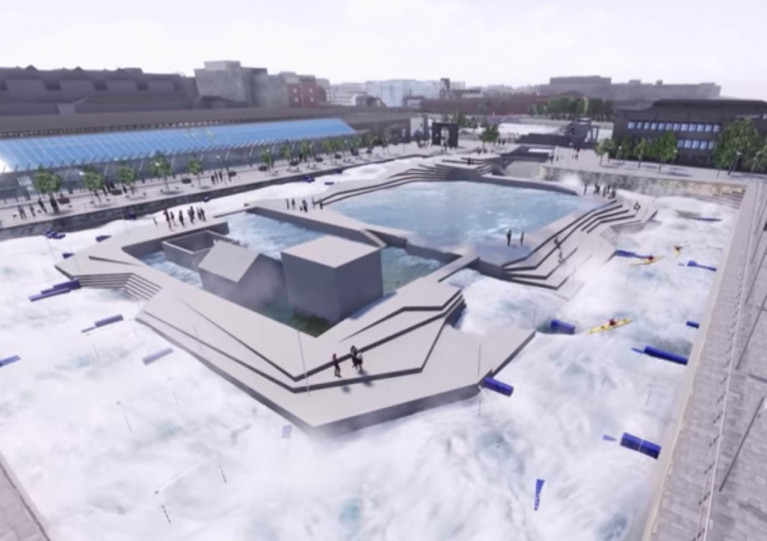

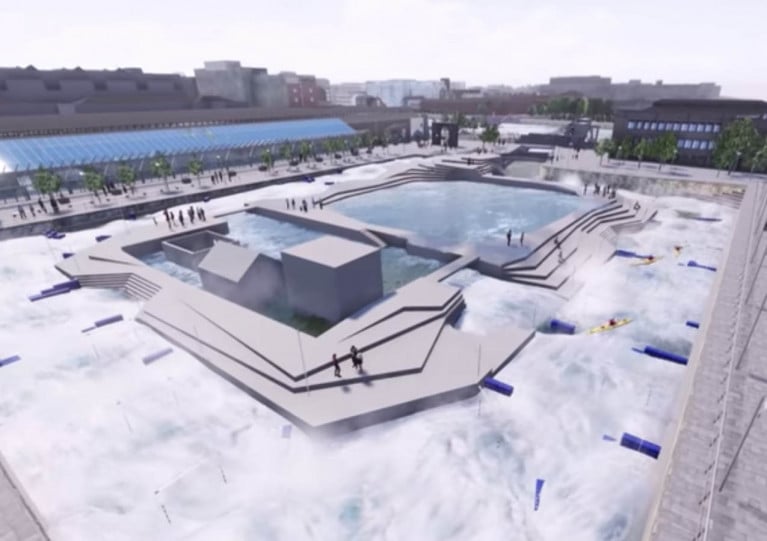

George’s Dock Lido Campaigners Reveal Conceptual Images of Proposal for Heated Outdoor Pool in Dublin City Centre

Campaigners for a heated outdoor swimming pool at the site of Dublin City Council’s ill-fated whitewater rafting course proposal have released conceptual images to visualise how it could transform the Docklands area.

Last year the two doctors behind the plans garnered more than 4,000 signatures backing their concept for the outdoor pool.

They’ve since teamed up with architects at lido specialists Studio Octopi, who provided the artist’s impressions of what the George’s Dock Lido could look like.

“We believe these images confirm the wonderful opportunity that exists for the people of Dublin to enjoy a world-class swimming facility at this publicly owned historic site,” the George’s Dock Lido Campaign says.

We're delighted to announce the release of our conceptual images of what a 100% public swimming facility could look like at George's Dock. Providing something for all citizens. The images created by @StudioOctopi demonstrate the ambition we should have for this public site. pic.twitter.com/ftOWjXspSx

— GeorgesDockLido, Dublin (@GeorgesDockLido) November 30, 2022

Their concept comprises a 50-metre Olympic-sized swimming pool, heated for use in all seasons, with a smaller “learning pool” and a diving pool with boards and platforms.

The design also features a building to include saunas, community function rooms, a restaurant, café and viewing gallery as well as “water gardens” with public seating and performance areas.

And the campaign says that sustainability is central to their concept, as the lido could be heated with water from the Ringsend incinerator via the Dublin District Heating System.

The campaign has also hit back at counter-proposal for the site that would split it between a public pool and a training area for emergency services, arguing that such a facility “would be unused for much of the year”.

A Dublin MEP says the intended site of the now-scrapped inner city white-water rafting proposal would be ideal for a heated outdoor pool.

An online petition by two doctors backing a proposal for a public lido at the George’s Dock site previous earmarked for an ‘elite’ kayak slalom course has garnered more than 4,000 signatures.

And writing in The Irish Times this week, Ciaran Cuffe of the Green Party suggests that Dublin could look to the likes of the Piscine de Wacken municipal swimming complex in Strasbourg for inspiration.

“The main attraction is an outdoor heated 50m pool, and it also features a shallow children’s pool for families, and an area where older people take aqua-aerobics classes and others practise synchronised swimming,” he says.

“All these facilities are open all year, even when temperatures fall below zero and steam rises off the water.”

He adds: “Figures supplied to me by the city [of Strasbourg] indicate that it costs €3 million annually to run, of which €1 million is recouped from admission charges.

“The €5 entry fee is a fraction of the €50 that might have been charged for entry to the white-water rafting proposal.”

Cuffe also posits that such a pool at George’s Dock could be heated by waste heat from the Ringsend waste-to-energy plant, as its pipes have already been laid along the north quays.

And he argues that in contrast to the poor reception that met the council’s rafting course plans, Dublin is crying out for a city-owned and operated outdoor pool, with demand exceeding supply across the capital’s dwindling number of public pools — not to mention the lack of access to the Clontarf baths due to insurance issues.

The Irish Times has more on the story HERE.

Lack of financial and public support is being cited as the reason for scrapping plans for a white-water rafting course in Dublin city centre, as RTÉ News reports.

Costs for the controversial scheme planned for George’s Dock had risen to €25 million earlier this year as Dublin City Council (DCC) sought expressions of interest in the contract for the project.

It followed shortly after a council statement that it remained “hopeful” of securing the funds required for the “elite” white-water rafting and kayaking circuit, which was first suggested in early 2018.

However, DCC’s Capital Programme 2022-2024 report, from chief executive Owen Keegan, says there has been a “considerable amount of negative commentary related to this project…that appears impossible to reverse and that has undermined the planned funding of the project”.

RTÉ News has more on the story HERE.

Costs of Dublin White-Water Rafting Project Rise to €25m as Council Seeks Expressions of Interest

Coats for the controversial white-water rafting centre proposed for George’s Dock have risen to €25 million as Dublin City Council seeks expressions of interest in the contract.

RTÉ News reports on the latest figures release by the council which show an additional €2 million in costs since the project was approved over a year ago.

The council documents also advise would-be contractors that the scheme remains “subject to funding” following issues that emerged last year.

In December the council said it “remains hopeful” of securing the funds required despite the State rejecting a grant application that would have covered a quarter of its costs.

The ‘elite’ white water rafting circuit was first mooted in early 2018 when a design tender was issued as part of redevelopment plans for George’s Dock, adjacent to the IFSC in the city centre.

City councillors were presented with plans in January 2019, with costs estimated at €12 million for a facility serving ‘elite kayak slalom’ squads, as well as training for emergency services besides potential recreational use.

Then Dublin Lord Mayor Nial Ring described the scheme as a “white elephant”.

RTÉ News has much more on the story HERE.

Dublin City Council Aims to Lock Down Funding as Tender for White-Water Rafting Project Pushed Back to 2021

The white-water rafting course proposed for Dublin city centre is still on the agenda — though the tender for its construction has been pushed back to next year.

According to TheJournal.ie, it’s emerged that “challenges” arising from the coronavirus pandemic have forced a delay in Dublin City Council’s plans.

It’s also reported that the council “remains hopeful” of securing the funds needed for the controversial €23 million project — despite the State rejecting a grant application that would have covered more than a quarter of its costs.

TheJournal.ie has much more on the story HERE.

The Government has refused a grant application from Dublin City Council that would have funded its plans for a white water rafting course in the city centre to the tune of €6.6 million, as TheJournal.ie reports.

Councillors who voted last December to approve the controversial plans for George’s Dock were told that that €5 million of the project’s €23 million cost would come from development levies, with €4 million from the council’s own reserves, and the rest coming from grants, predominantly from the State.

But it’s now emerged that just weeks after the council vote, an application by the local authority made last year under scheme 1 of the Large Scale Sports Infrastructure Fund was refused as it “did not score highly enough”.

The news comes a week after the council announced proposals for a floating outdoor pool and sauna faclility adjacent to the George's Dock scheme.

TheJournal.ie has much more on the story HERE.

A site on Custom House Quay adjacent to the planned white water rafting course in George’s Dock has been earmarked for a €15 million outdoor pool, as TheJournal.ie reports.

The scheme being proposed by Dublin City Council is modelled after a similar facility in Helsinki, Finland — complete with a pool floating on the River Liffey and saunas in an adjacent quayside complex.

It also appears superficially similar to the ‘urban beach’ project that was proposed for Dun Laoghaire, in the vein of Berlin’s Badeschiff, but was put on hold a number of years ago over funding issues within the former Dun Laoghaire Harbour Company.

Custom House Quay was chosen as the optimum site for the project as its proximity to the controversial rafting course would help develop the area “into a hub for water based recreational activity in the city”, says Docklands area manager Derek Kelly.

TheJournal.ie has more on the story HERE.