Displaying items by tag: P&O (Irish Sea)

Former B+I Line Freight-Ferry Bound for Turkish Breakers

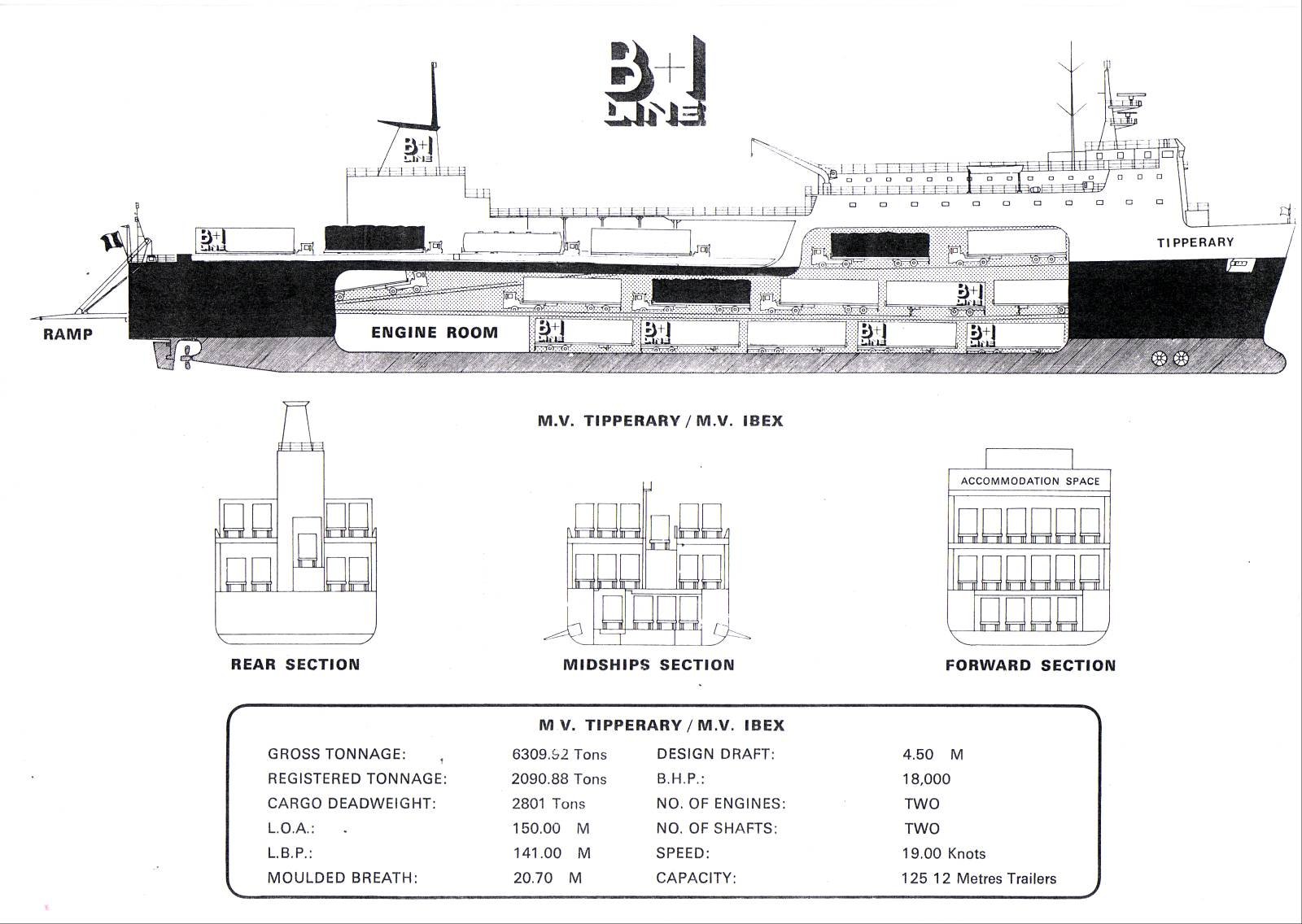

#FERRY NEWS-P&O Irish Sea's Larne-Troon freight-ferry Norcape (14,087grt) departed the Co. Antrim port last week to be broken-up at ship-breakers in Aliaga, Turkey. She originally served B+I Line as the Tipperary, but her last sailings took place on the North Channel in late November, as the ageing vessel is in her fourth decade of service, writes Jehan Ashmore.

The 125-trailer capacity ro-ro was not replaced on the single-ship operated route which closed for the winter months, though sailings will resume next March by the 92m fast-ferry Express. In the meantime freight traffic will be accommodated on the companies Larne-Cairnryan service.

Yesterday morning Norcape transitted the Strait of Gibraltar having called en-route to Falmouth several days previously. She represented the last vessel to serve in Irish waters with a direct link to B+I Line, the state-owned operator which was sold in 1992 to ICG, parent company of Irish Ferries.

When she arrives in Aliagra, this is where her former P&O fleetmate European Mariner (5,897grt) was scrapped after also serving Larne-Troon sailings until last July. Norcape entered the North Channel route replacing the smaller 53-trailer capacity vessel.

Prior to then Norcape had been in laid-over in Liverpool docks when European Endeavour replaced her in February on the Dublin-Liverpool route. To read more click HERE.

Norcape's return to the Irish Sea service in 2009, reflected her original career for P&O. She was named Puma in 1979 from the Japanese shipyard at the Mitsui Engineering & SB Co Ltd, Tamano, however she was chartered to B+I Line and renamed Tipperary. To read more and to view a deck-drawing profile, click HERE.

Her career started with a new Dublin-Fleetwood route jointly operated with P&O, who contributed with a sister, the Ibex. The P&O brand name Pandoro stood for P and O Ro, their roll-on roll-off freight division. The route's UK port switched to Liverpool in 1988 with Tipperary remaining on the route until sold to North Sea Ferries in 1989 and renamed Norcape.

Before her transfer to the North Sea, Tipperary collided with the 4,674grt bulker Sumburgh Head off the entrance to Dublin Port in 1988. Incidentally the two vessels, under different names and ownership were in Dublin Port in 2010, as previously reported (with photo) click HERE.

- Ports and Shipping News

- Norcape

- P&O (Irish Sea)

- B+I Line

- European Endeavour

- Ferry news

- Irish Sea Ferries

- Irish Sea ferry news

- LarneTroon

- MV Tipperary

- Turkish shipbreakers

- P&O Express

- MV Ibex

- Pandoro

- Aliagra,Turkey

- MV Norcape

- ICG

- ICG Group

- Irish Continental Line

- North Channel ferry routes

- LarneCairnryan

- Irish Ferries

Dublin Port Outlines Plans for First Dedicated Cruise Terminal

In order to facilitate this growth, the draft proposes switching existing berths used by large cruiseships away from unattractive cargo-docks in Alexandra Basin's West and East and at Ocean Pier. Up to three alternative locations were examined and the port agreed that the option identified in the Dublin City Council's Area Plan of the North Quay Extension is the optimum location.

Before any such development, it would require relocating an existing roll-on roll-off terminal (No.3), which is currently in use by P&O Irish Sea for their Dublin-Liverpool service. The company operate three sailings daily on the central corridor route.

The new facility could accommodate two large cruise ships simultaneously and would be much larger than the 43,524grt The World, the luxury resort vessel operated by Residensea, which docked at the North Wall Extension in 2010 (for report click HERE).

The location is on the doorstep to the East-Link Bridge and the neighbouring O2 Arena and Point Village developed by Harry Crosbie, who called for the relocation of cruise callers to be sited upriver.

According to the draft, the closer proximity to the city-centre would provide a stronger presence and a more accessible link with the city. It would also avoid the unnecessary longer bus transfers between cruise berths and visitor attractions in the city-centre and locations in counties Wicklow and Meath.

Construction of facilities for a cruise terminal would expensive as it will involve new quay walls capable of accepting large cruise vessels but this could only be done after dredging the channel to a depth of 10.5m.

The facilities of the terminal are to incorporate a reception, tourist information and interpretive centre, a dedicated entrance for pedestrians, coaches, vehicles and traffic management measures would be implemented.

In addition the site would also require the expensive exercise in re-locating ESB underwater high-voltage cables. The initial costs suggest to develop new terminal facilities and associated works would be in the region of €30m.

Dublin Port Company, state that due to the relatively low revenues generated by cruise ships, such an investment alone could not be justified, however, they could part-fund the development but additional funding would be required from other sources.

- Dublin Port

- Dublin Port Company

- The World

- Cruise Liners

- Harry Crosbie

- Port of Dublin

- Ports and Shipping News

- Point Village

- P&O (Irish Sea)

- Cruise Liner news

- Ocean Pier Dublin Port

- O2 Arena

- EastLink bridge

- Dublin Port draft masterplan

- DPC

- North Wall Quay Extension

- Residensea

- Dublin Port Terminal 3

- Alexandra Basin Dublin

New Celtic Link Ferry on Re-Positioning Voyage off Africa

CLF are to charter Celtic Horizon for a five-years and the 25-knot capable vessel will takeover the existing thrice-weekly round trip sailing schedule from ro-pax Norman Voyager. Between 2 January -19 February 2012, CLF will be the only continental ferry operator running services as rivals Irish Ferries will be taking their cruiseferry Oscar Wilde for annual dry-docking. To read more click HERE.

In addition there will be no sailings between Cork-Roscoff, as operators Brittany Ferries last sailing for this year is 29 October, served by 'flagship' Pont-Aven. The 2012 season starts in late March.

Celtic Horizon is the first vessel to be named with a 'Celtic' prefix of part of their ferry operations, since the company brought European Diplomat from former route operators P&O (Irish Sea) in 2005. The freight-ferry renamed Diplomat, served Celtic Link Ferries until 2009. Since then she has been on charter in the Caribbean until this summer when she was sold to the breakers in Alang, India. To read more click HERE.

As for Celtic Horizon, she was built in 2006 and spent her last season this year as Cartour Beta while on charter to C&T's routes between Naples and Sicily, to read more click HERE. The 186m ro-pax is believed to be heading for Gibraltar while en-route to Rosslare.

During her Irish service, she will maintain Italian registry of Bari whereas her predecessor Norman Voyager changes flags from the UK to that of the French tricolour. Both vessels are similar as they share a ro-pax design which has proved popular for Italian shipbuilders Cantieri Navali Visentini.

The 2008 built Norman Voyager of 26,904grt is to revert to LD Lines operation and used on their 'Motorways of the Seas' St. Nazaire-Gijon service, though she was to enter on the Marseilles-Tunis route. Her new role on the Franco-Iberian route sees the replacement of Norman Asturias.

Irish Sea Cross Channel Fast-Ferry Services On Declining Trend

The third service between Belfast-Stranraer is in the hands of rivals Stena Line which maintain the HSS Stena Voyager (1996/19,638 grt) on sailings but only to around mid-November. She will be replaced by conventional sister-ships which will be introduced on the North Channel's newest port when services switch from Stranraer to a new terminal close to Cairnryan.

Finally the fourth fast-ferry is Irish Ferries marketed 'Dublin Swift' service which runs on the Dublin-Holyhead route served by Jonathan Swift (1999/5,989 grt). The craft built by Austal in Fremantle, operates alongside the conventional cruise-ferry Ulysses.

Stena Line's decision to terminate HSS Stena Explorer sailings between Dun Laoghaire-Holyhead this day last week follows fast-ferry Stena Lynx III's end-of-season Rosslare-Fishguard sailings earlier this month.

From next year, Dun Laoghaire-Holyhead sailings are to be seasonal-only and according to Stena Line they hope to resume fast-ferry sailings in April or May though no exact date has been set. Unlike the central corridor route which was entirely dependent on HSS operations, the Rosslare-Fishguard route remains operating year-round with the conventional ferry Stena Europe.

As a result of the discontinued fast-ferries, the HSS Stena Explorer is now spending a lay-up period in the Welsh port for the winter. The smaller Stena Lynx III is also 'wintering' but in on the opposite side of the Irish Sea in Dun Laoghaire, where the vessel has done so in previous years.

The lay-up of both fast-ferries in Dun Laoghaire and Holyhead is ironic considering that neither ports' are connected by the very craft that used to share sailing rosters in recent years. In addition the wintering of these catamaran craft is the first time that this has occurred since the pioneering Stena Sea Lynx fast-ferry launched such sailings in 1993.

This first 'Lynx' provided seasonal sailings on the route with conventional car-ferry Stena Hibernia, the former St. Columba, custom-built in 1977 for Sealink /British Rail. She was given a second name under Stena ownership, the Stena Adventurer and remained on the 57 nautical-mile route until replaced in 1996 by the year-round operated HSS Stena Explorer.

Apart from cross-channel fast-ferry services, the Isle of Man is served by the Isle of Man Steam Packet Co. Ltd's routes linking the islands capital Douglas with Belfast, Dublin, Heysham and Liverpool (Birkenhead) in the winter. These routes include seasonal services which are operated by a combination of conventional tonnage using Ben-My-Chree and fast-ferry Manannan (1998/5,089grt), a former US Navy vessel, to read more click HERE. For sailing schedules, vessel type deployed on route and for fares click HERE.

- Dublin Port

- Irish Ferries

- Dun Laoghaire

- Stena Europe

- Holyhead

- P&O Ferries

- Belfast Harbour

- Stena Line

- Larne

- Ports and Shipping News

- Ulysses

- P&O (Irish Sea)

- Cairnryan

- Ferry news

- Stena Explorer

- Stena Express

- FastFerries

- Cruiseferry

- Manannan

- Isle of Man Steam Packet Co.

- Stena Voyager

- Belast Port

- Isle of Man ferry services

- P&O Express

- Irish Sea fastferries

- Stena 'Lynx'

- BenMyChree

- Dublin Swift

- Stena Sea Lynx

Prior to her arrival on the North Channel, Norcape had been laid-up in Liverpool since February 2010 after the former B+I Line vessel (MV Tipperary) was replaced by European Endeavour on the central corridor route to Dublin. As of this week the ro-pax freight vessel which has been running in a freight-only mode will now carry motorists likewise to her route fleetmates Norbank and Norbay.

With the departure of European Mariner from the Irish Sea, she follows a trio of former Stena Line freight-ferry sisters which were made redundant since the closure of the Belfast-Heysham route late last year. It is believed the sisters Stena Seafarer, Stena Leader and Stena Pioneer have been sold to Russian interests to serve in the Black Sea in connection to the 2014 Winter Olympics in Sochi.

The sisters were renamed, Stena Pioneer became Ant 1, Stena Seafarer is the Ant 2 and Stena Leader is the Anna Marine. They departed Belfast Lough in mid-June to Sevastopol in the Ukraine under the Moldovan flag and with a port of registry in Giurgiulesti.

- Port of Larne

- Belfast Lough

- Stena Line

- Ports and Shipping News

- RoPax

- North Channel

- P&O (Irish Sea)

- B+I Line

- European Endeavour

- Ferry news

- Belfast Lough News

- RosslareFishguard

- LarneTroon

- European Mariner

- Freightferries

- MV Tipperary

- Central Coridoor route

- BelfastFleetwood

- Stena Europe ferry

- 2014 Winter Olympics

- Sochi

- Black Sea

- Turkish shipbreakers

- Izmir

- Turkey

- Winter Olympics 2014

- Irish Sea ferry motorists

Celtic Link Ferries First Ferry Goes to the Breakers

Launched as the Stena Tranporter, the career of the 16,000 tonnes has spanned over three decades in which the 151m vessel changed through several owners and subsequent vessel renamings.

It was when she served under the name Baltic Ferry, that her most notable career took place in 1982 during her wartime deployment as part of the

Falklands Islands Task Force. The 151m vessel was requisitioned by the British Ministry of Defence which saw the ship engaged in military operations when RAF Harrier Jump-Jet aircraft transferred store supplies from the deck of the ship as part of the war-effort in the South Atlantic Ocean.

In 2001 the vessel undertook ferry operations to Ireland as the European Diplomat on the Dublin-Liverpool route for the P&O (Irish Sea) route network. The following year she was transferred on the direct route to France until P&O pulled the plug on the continental service in December 2004, leaving Irish Ferries as the sole operator.

It was not until February 2005 that the route resumed service but this time under new owners Celtic Link Ferries. The O'Flaherty brothers, owners of a large fishing fleet in Kilmore Quay purchased the vessel and renamed her Diplomat. See PHOTO.

For the next four years she built up a steady customer loyalty between freight-hauliers drivers and car-only accompanying passengers who were accommodated in the ship which had a limited passenger certificate for 114 passengers. In addition she had a license to transport livestock.

Currently Celtic Link Ferries operate the ferry Norman Voyager but the 800-passenger / 200-car ro-pax vessel will only remain on the route until an October debut of a larger sistership the Cartour Beta.

The vessel is running this season between Italy and Sicily and with an added deck the 27,552 tonnes vessel has an increased capacity for passengers, cars and enhanced range of facilities. Recently the company had run a competition to name the new vessel which is to begin a five-year charter on the service between Wexford and Normandy.

- Wexford

- irish sea

- Diplomat

- Celtic Link Ferries

- Kilmore Quay

- Stena Rederi

- Marine Express

- RosslareCherbourg

- Norman Voyager

- Ports and Shipping News

- Normandy

- RoPax

- DublinLiverpool

- P&O (Irish Sea)

- Ferry news

- Cartour Beta

- Irish Sea Ferries

- Stena Transporter

- Baltic Ferry

- European Diplomat

- O'Flaherty Brothers

- Falklands Islands Task Force

- Hyundai Heavy Industries

- Freighthauliers

- Livestock

- RAF

- Harrier JumpJets

Spot the ‘Big’ Difference! From Containership to Cruiseship

It may just be another cruiseship visiting Dublin Port today, but the gleaming white painted Costa Marina started her career in complete constrast as a grey-hulled containership, writes Jehan Ashmore.

The cruiseship has some unusual hull design features indicating clues to her origins as the containership Axel Johnson (click PHOTO) notably the pronounced chine bow (horizontal-lines) still clearly visible under her name when launched in 1969 at the Oy Wärtsilä shipyard in Turku, Finland.

She was the leadship of five sisters of over 15,000 tonnes ordered by her Swedish owners, Johnson Line. The next sister completed, Annie Johnson was also converted into a cruiseship and she too serves Costa Cruises as their Costa Allegra.

Axel Johnson measured 174m in length and was fitted with two deck-mounted gantry-cranes to handle containers. Her design even catered for passengers but was limited to just four-persons compared to today near 800 passenger capacity and an increase in tonnage to 25,500. To see how she looks now click PHOTO

Her Scandinavian owners sold the vessel in 1986 though it was not until 1988 that the containership came into the ownership of her current owners Costa Cruises who converted the vessel at the Mariotti Shipyard in Genoa. Two years later the ship emerged as the Costa Marina (to see another click HERE).

She has nine decks which feature restaurants, bars, jacuzzis, pools, gym, treatment rooms, sauna, an outdoor jogging track, theatre, casino, disco and a squok club with PlayStation entertainment. Accommodation comprises for 383 cabins including 8 suites with private balcony and a crew close to 400.

Costa Cruises were founded in 1924 but they are a relative newcomer to Dublin. The vessel departs this evening from Ocean Pier bound for the Icelandic capital of Reykjavik. To view the ship's web-cam click HERE (noting to scroll right down the page).

Costa Marina and indeed larger cruiseships may in the future relocate upriver to berths much closer to the city-centre, should proposals by Dublin City Council take pace. In order to boost tourism numbers a dedicated new cruiseship terminal could be built at a site close to the O2 Arena and East-Link bridge.

The site at North Wall Quay Extension is currently in use by ferry operator P&O (Irish Sea) for their ro-ro route to Liverpool. To read more in a report in yesterday's Irish Times click HERE.

Superfast Sisterships for Stena's Northern Route

Stena will lease the ferries for a three year period from Tallink, the Baltic Sea based shipping group. (Click here for photo of Superfast VIII in ice-flow waters). The charter arrangement includes an option to extend for a further year.

The distance between the new ferry terminal named the 'Loch Ryan Port' at Old House Point (which is just north of Cairnryan) is approx. 8kms apart from Stranraer taking the coastal (A77) road along the Loch that leads onto to Glasgow. At Cairnryan, rivals P&O (Irish Sea) who along with predecessing operators have run services on the route to Larne for several decades.

With a speed of 27-knots, passage times on the new Stena Belfast-Cairnryan route will take 2 hours 15 minutes, this compares to the existing time of 2 hours 50 minutes from Stranraer by conventional ferry and 2 hours taken by the HSS fast-ferry.

As a consequence of Stena operating from Loch Ryan Port, passage times by the Superfast sisters will be reduced by 35 minutes as the Belfast terminal was also relocated in recent years. Though despite the relocated ferry terminals, the Superfast sisters scheduled 2 hours 15 minutes sailings from the new port will be slightly longer compared to the HSS Stena Voyager's 2 hour sailing time from Stranraer.

Also serving the Belfast Stranraer route are the conventional ferries, Stena Caledonia (formerly Sealink's St. David built at Harland & Wolff) and Stena Navigator, that served SeaFrance on Dover-Calais sailings as SeaFrance Manet. When the Superfast sisters replace the HSS Stena Explorer and the conventional ferries, perhaps there will be a new a role for the two vessels in replacing expensive to run fast-craft operated elsewhere.

In the meantime the Superfast pair will maintain running on Tallink's 26-hour Helsinki-Rostock until mid-August. The 2001 German will then undergo an extensive refit of passenger facilities and a new freight-only deck will be incorporated to cater for haulage operators increasing use of higher vehicles and double-deck freight units.

The 'Superfast' vessel naming theme derives from the original owners, Greek operator Superfast Ferries, which sold their Scandinavian operations to Tallink in 2006.

Farewell to Former B+I Line Freight-Ferry

This will enable P&O to offer up to three Ro-Pax style sailings a day on the 7.5 hour route instead of the previous two-plus one ro-ro (freight-only operated) service. The Norcape could take 125 drop trailers but only had 12-passenger cabins (for freight accompanied truck-drivers).

Norcape was only re-introduced onto the Irish Sea last year but made her final departure tonight as the vessel headed into a foggy Dublin Bay.

In 1979 the Japanese built vessel was launched as the Puma for P&O but was chartered to B+I Line and renamed Tipperary. During the 1980's the vessel first operated a then new Dublin-Fleetwood route jointly operated with P&O, alongside Tipperary's Ro-Ro sister, Ibex. The P&O brand name Pandoro cleverly stood for P and O Ro, their roll-on roll-off freight division.

Cut-away deck profile of M.V. Tipperary and sistership of M.V. Ibex

The route's UK port switched to Liverpool in 1988 with Tipperary remaining on the route until sold to North Sea Ferries in 1989 and renamed Norcape. Prior to her transfer to the North Sea, the Tipperary collided with the 4,674grt bulker Sumburgh Head off the entrance to Dublin Port on 18 February 1988. For a report and photo taken of the two vessels which met at the port last year under different names click here.

Like the Tipperary the Sumburgh Head was built in Japan too by Hashihama Zosen KK, Imabari in 1977, yard no. 624. During her Dublin Bay incident, the vessel was owned by Christian Salvesen (Shipping) Ltd based in Edinburgh.

In 1990 she was sold to Barra Head Shipping Ltd and renamed Hood Head under the Irish flag. Three years later sold again to the KG Jebsen group and renamed Husnes.

The Panamanian flagged bulker remained with the Norwegian owner until 2003 when sold to her current owners, Wilson Shipowning AS of Bergen and renamed Wilson Tana, this time under the Maltese flag.

Celtic's French Ferry Figures

Operating the route is the 2008 built ro-pax Norman Voyager, at 26,500grt, the vessel has a larger passenger capacity for 800 and additional facilities compared to the previous vessel, Diplomat. In addition the newer Italian built vessel has space for 200 cars and 120 trucks. The ro-pax has a service speed of 22.9 knots is claimed to be the fastest ship serving on the direct routes to France, taking 18-hours.

In 2005 the Wexford based company took over the route from P&O (Irish Sea) and continued to offer what was primarily a freight-only service served by the existing route vessel, the 16,776grt European Diplomat. The vessel was also sold to Celtic Link and renamed Diplomat and could only provide a limited passenger certificate for 74, which was mostly taken up by truck-drivers.

With the introduction in December 2009 of the chartered Norman Voyager from Meridian Marine Management, the Diplomat was laid-up in Waterford (click here). The 1978 built vessel was then chartered by Celtic Link to trade in the Caribbean Sea.