Displaying items by tag: irish sea

Irish Sea Ports Ready To Roll to Save the UK from Brexit Trade Traffic

According to one of the UK's ports' operators, the Peel Ports Group say they have the capability to limit the impact (of Brexit) on the Britain's expected departure from the EU on 31 October which is expected to have on trading.

Among the ports of the Group are Liverpool, Heysham and Sheerness (London Medway) which have a combined capacity to handle 1 million RORO (roll on, roll off) units per year. The ports could play a vital role in ensuring cargo flow freely through UK ports as trade is expected to be challenging across the Dover Straits following Brexit.

The ports on the Irish Sea and on the Medway have already taken steps to improve resilience ahead of Brexit. These include increased throughput capacity for HGV trailers and storage to support smooth trade operations by roll-on roll-off (Ro-Ro) ferries.

Heysham has unrestricted access to the Irish Sea and already caters for numerous daily Ro-Ro sailing from providers including Seatruck, Stena Line and the Isle of Man Steam Packet.

Peel Ports says that transporting non-perishable freight unaccompanied is faster and more cost effective than relying on driver-accompanied hauliers - of whom there are an acute shortage of across the continent - to transport cargo from Europe to the UK and vice versa.

Routing via ports such as London Medway would be just as efficient as the existing options through the Dover Straits, as although the sea leg is longer, road miles are reduced, according to Peel Ports. They also added Door-to-door, cargo owners could reduce cost, increase resilience, avoid congestion and reduce carbon emissions.

For more on this story click here.

Marine Notice: Geohazard Investigation In Irish Sea

A geohazard investigation to provide support for ongoing research at the Irish Centre for Research in Applied Geosciences (iCRAG) will be undertaken in the Irish Sea from Thursday 24 October until Wednesday 6 November, weather dependent.

The locations of these works at various shipwreck sites off the Louth coast are provided in Marine Notice No 41 of 2019. The equipment and techniques to be used include:

- Surveying using multibeam echo sounders and shallow seismics (pinger);

- Passive acoustic monitors (PAM) deployed at the indicated locations near the seabed to record acoustic data;

- Seismic sparker equipment to reveal subsurface structure and features;

- Sediment core taken at indicated locations to characterise the lithological characteristics of the seabed with grab samples taken within a 3nm range of these locations.

The surveys will be completed on a 24-hour schedule by the RV Celtic Voyager (callsign EIQN) which will display appropriate lights and signals.

Acoustic surveying using a multibeam echo sounder and seismic sub-bottom surveys using a sparker/pinger system will be performed during both day and night operations in accordance with safe operating practices regarding MMO procedures and cognisant of fishing gear.

Sediment sampling using cores will be carried out during daylight hours due to limited ship mobility. PAM units will be deployed and retrieved at both night and day as dictated by survey conditions.

Full details of the survey locations as well as contact information are included in Marine Notice No 41 of 2019, a PDF of which is available to read or download HERE.

Routes On Irish Sea Prepare for IMO Global Sulphur Cap 2020

Ferry operator Stena Line is currently engaging with freight customers on its Irish Sea routes to advise them of an important International Maritime Organisation (IMO) environmental regulation which will come into effect on 1st January 2020.

The goal of the Global Sulphur Cap 2020 Regulation is to significantly and progressively reduce sulphur emissions within all areas of international shipping and applies to all ship operators world-wide.

A number of regulations have been introduced over the past years aimed at making the shipping industry more environmentally friendly, such as the 2015 sulphur cap in the English Channel, North Sea and Baltic Sea. This new mandatory cap of 0.5% sulphur in ships’ fuel will now require all operators on the Irish Sea to ensure reduced emissions by switching to low sulphur fuels from 1st January 2020.

The new industry regulation will see operating costs increase outside of Stena Line’s control.

As a result, at the start of the new year all freight shipments on Stena Line’s Irish Sea routes will be subject to a higher fuel charge, in order to cover the additional costs incurred. Further details on these costs can be found on Stena Line’s freight website via this link.

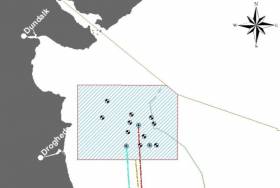

Geophysical surveys are being undertaken in the Irish Sea in outer Dundalk Bay from this week.

The work is required to provide bathymetric and subsurface information for the development of the Oriel Wind Farm project.

Survey work was expected to start yesterday, Tuesday 20 August, with a view to completion by Monday 30 September, though these dates are weather dependent.

The surveys will be completed using the AMS Retriever (Callsign MEHI8), a versatile multi-purpose, shallow draft tug.

This vessel is towing survey equipment up to 100 metres astern and will be restricted in its ability to manoeuvre.

Other vessels are requested to leave a wide berth. The AMS Retriever will be operating from approximately 6am to 9pm during survey works.

Details of co-ordinates of the survey area are included in Marine Notice No 29 of 2019, a PDF of which is available to read or download HERE.

The main lay installation works for the Rockabill Subsea Cable will take place from tomorrow, Saturday 20 July, to Sunday 1 September.

Using the vessel CS Teliri (callsign IBBT), the Rockabill cable system will be conducted from north of Lambay Island across the Irish Sea to Southport in England.

The cable itself is armoured and has an OD of 38mm. The cable ship will firstly clear the route of seabed debris with a grapnel before installing the cable.

During installation operations, the vessel will be moving slowly along the route while towing a sea plough to bury the cable into the seabed. During these works the vessel will have restricted manoeuvrability as it completes the work scope.

Deployed guard vessels will monitor the exposed areas of cable at crossing locations while burial progresses.

Ships are asked to avoid using anchors, bottom-trawl fishing and other seabed gear within half a mile of this cable route, and to maintain a safe distance from the cable ship during installation operations and that static gear be relocated from the route prior to commencement of operations.

Vessels are requested to pass at a safe speed and distance and fishing vessels are advised to remain a safe distance from the areas identified. Guard vessels will be deployed at certain cable crossing points to aid in monitoring the exposed areas and will advise of safe distances locally. The vessels will monitor VHF Channel 16 at all times.

The location co-ordinates of the operation are as included in Marine Notice No 24 of 2019, a PDF of which is available to read or download HERE.

Marine Notices: ADCP Deployment In Waterford Harbour, EirGrid Interconnector Cable Survey In Irish Sea

TechWorks Marine Ltd is deploying trawl-resistant bottom mounted Acoustic Doppler Current Profiler (ADCP) frames in Waterford Harbour this week.

It is anticipated that the ADCPs will be deployed between today, Monday 8 July, and this Friday 12 July, depending on the weather. If the deployment is delayed due to the weather, it will be carried out on the next viable tide and weather window. Update: the ADCPs will now be deployed on or after Thursday 18 July.

The frames will be deployed from the vessel James (callsign EITT2). The frames will be on the seafloor for a minimum period of one calendar month and a maximum period of two months (weather permitting).

The ADCPs will be measuring currents through the water column at each location over the deployment. This data will be used to validate a hydrodynamic model of the area being developed for Irish Water.

Each frame will have one ADCP sensor, an acoustic pinger, an acoustic release and a rigid recovery buoy.

The frames are approximately 1m2 and will remain on the seafloor for a period of up to 30 days, after which the frame will be retrieved using the acoustic release and recovery buoy.

There will be no surface marker during the extent of deployment so vessel traffic will not need to avoid the area but should be aware of its presence.

Details of the relevant co-ordinates are included in Marine Notice No 22 of 2019, a PDF of which is available to read or download HERE.

Meanwhile, planned cable survey works on the EirGrid East West Interconnector are being carried out by the vessel Deep Helder (callsign PBYU) until this Thursday 11 July. During this survey, the vessel will be deploying underwater survey equipment along a thin 50m corridor.

Fishermen are advised not to leave any static fishing equipment in the vicinity of the survey route (250 metres) and keep a safe distance of at least one nautical mile from the survey vessels that will be operating with towed equipment and will have restricted manoeuvrability.

In addition, the survey vessel Ping will carry out operations in the near-shore waters off Rush, Co Dublin from next Monday 15 July. Near-shore survey operations will take place between beach HW mark and the 10m water depth contour.

Details of co-ordinates and survey contacts are included in Marine Notice No 21 of 2019, a PDF of which is available to read or download HERE.

Planned works on the Portrane Pre-Lay Shore End installation for the Rockabill Subsea Cable are being carried out from the coast of Portrane, Co Dublin.

Scheduled to start yesterday. Monday 1 July, they will continue to next Wednesday 10 July. During this first Pre-lay Shore End phase of the project, the cable will be installed and buried in the Irish Sea by the utility vessel Roxane Z (Callsign FIRJ).

The vessel will monitor VHF Channel 16 at all times. All vessels, particularly those engaged in fishing, are requested to give the Roxane Z a wide berth and keep a sharp lookout in the relevant areas.

Details and co-ordinates of the work area are included in Marine Notice No 20 of 2019, a PDF of which is available to read or download HERE.

Another recent Marine Notice includes an updated schedule of examinations for the Certificate of Competency for Deck Officers, Marine Engineer Officers, Skippers and Second Hands, commencing Monday 2 September this year.

Irish Sea: No-Deal Brexit ‘Would Have Severe Impact on Trade between Dublin and Holyhead

The Irish Examiner writes that the Taoiseach has said that a no-deal Brexit would have a severe impact on the Holyhead/Dublin trade route.

Speaking at the 20th anniversary of the British-Irish Council (BIC) in Manchester, Leo Varadkar said Ireland would have to impose tariffs on goods entering the state from the UK.

“I think in the event of a no-deal Brexit, there would be a very severe impact on trade between Dublin and Holyhead,” he said.

“In the first instance, we would have to impose tariffs on all goods being imported into Ireland from the UK and we would have to put in place the necessary customs checks and controls, and we have the infrastructure in place at Dublin Port and the staff to do that but we really don’t want to do it.”

Likewise, First Minister of Wales Mark Drakeford said his government would prepare for all eventualities.

More on the can be read here.

Departing Dublin Port last night was a small cruiseship when compared to the giants of the industry yet this caller is one of the most prolific visitors and on the Irish Sea this season, writes Jehan Ashmore.

The diminutive Corinthian of just 4,077 gross tonnage and a capacity of 110 guests had arrived from Douglas, Isle of Man from where the Maltese flagged vessel last month was among a quartet that formed a 'Week of Maidens' calls throughout Manx waters.

Prior to the Isle of Man, Corinthian called to Belfast Harbour as a regular and likewise in Dublin the Valletta registered ship has berthed on several occasions this season in the 'Docklands' quarter. This waterfront area once dominated by warehouses and cranes is now occupied by finance houses and appartments lining the Liffey quays between the city-centre and the Tom Clarke (East-Link) bridge.

With an overall draft of just 4m and 88m in length Corinthian easily made a transit of the bascule bridge and took a specific berth upriver along Sir John Rogersons Quay. Along this stretch is a legacy of the Dublin Docklands Development Authority which designated a south quay berth to encourage shipping activity to the quarter.

Instead of routine tea-time departures as typical of the majority of callers, Corinthian had spent a lenghtly stay. The Italian built ship launched for Renaissance Cruises and operated by subsequent owners until acquired by GCL in 2014 departed Dublin Port last night at 23.00hrs and made an overnight passage to Fishguard, Wales.

The port in Pembrokeshire operated by Stena Line Ports this year is scheduled for 33 callers, the majority of those will be carried out by Corinthian totalling 11 visits this season. Among these cruiseships so far to visit this scenic setting on the Pembrokeshire Coast National Park was Variety Voyager a vessel more akin to a private superyacht.

Corinthian is scheduled to return to Dublin next week on Tuesday, July 2nd.

A series of ecological surveys will take place in the Irish Sea off the Dublin and Wicklow coast between now and May next year to provide data on seabirds and marine mammal species to inform the development of the Dublin Array Wind Farm.

The survey dates are weather dependent but will comprise a survey in each calendar month until May 2020, commencing tomorrow (Monday 24 June), with additional monthly surveys this August and September.

The location of the surveys will be off the Dublin and Wicklow coast in the vicinity of the Kish and Bray Banks. Surveys will be undertaken in daylight hours and each will usually be completed over a period of two days.

For the initial survey, the work vessel will not be towing survey equipment. During subsequent surveys the vessels may be towing a hydrophone up to 100m astern and will be restricted in their ability to manoeuvre. Vessels are requested to leave a wide berth.

Details of co-ordinates of the survey areas, and relevant work vessels, are included in Marine Notice No 18 of 2019, a PDF of which is available to read or download HERE.