Displaying items by tag: Sumburgh Head

Farewell to Former B+I Line Freight-Ferry

This will enable P&O to offer up to three Ro-Pax style sailings a day on the 7.5 hour route instead of the previous two-plus one ro-ro (freight-only operated) service. The Norcape could take 125 drop trailers but only had 12-passenger cabins (for freight accompanied truck-drivers).

Norcape was only re-introduced onto the Irish Sea last year but made her final departure tonight as the vessel headed into a foggy Dublin Bay.

In 1979 the Japanese built vessel was launched as the Puma for P&O but was chartered to B+I Line and renamed Tipperary. During the 1980's the vessel first operated a then new Dublin-Fleetwood route jointly operated with P&O, alongside Tipperary's Ro-Ro sister, Ibex. The P&O brand name Pandoro cleverly stood for P and O Ro, their roll-on roll-off freight division.

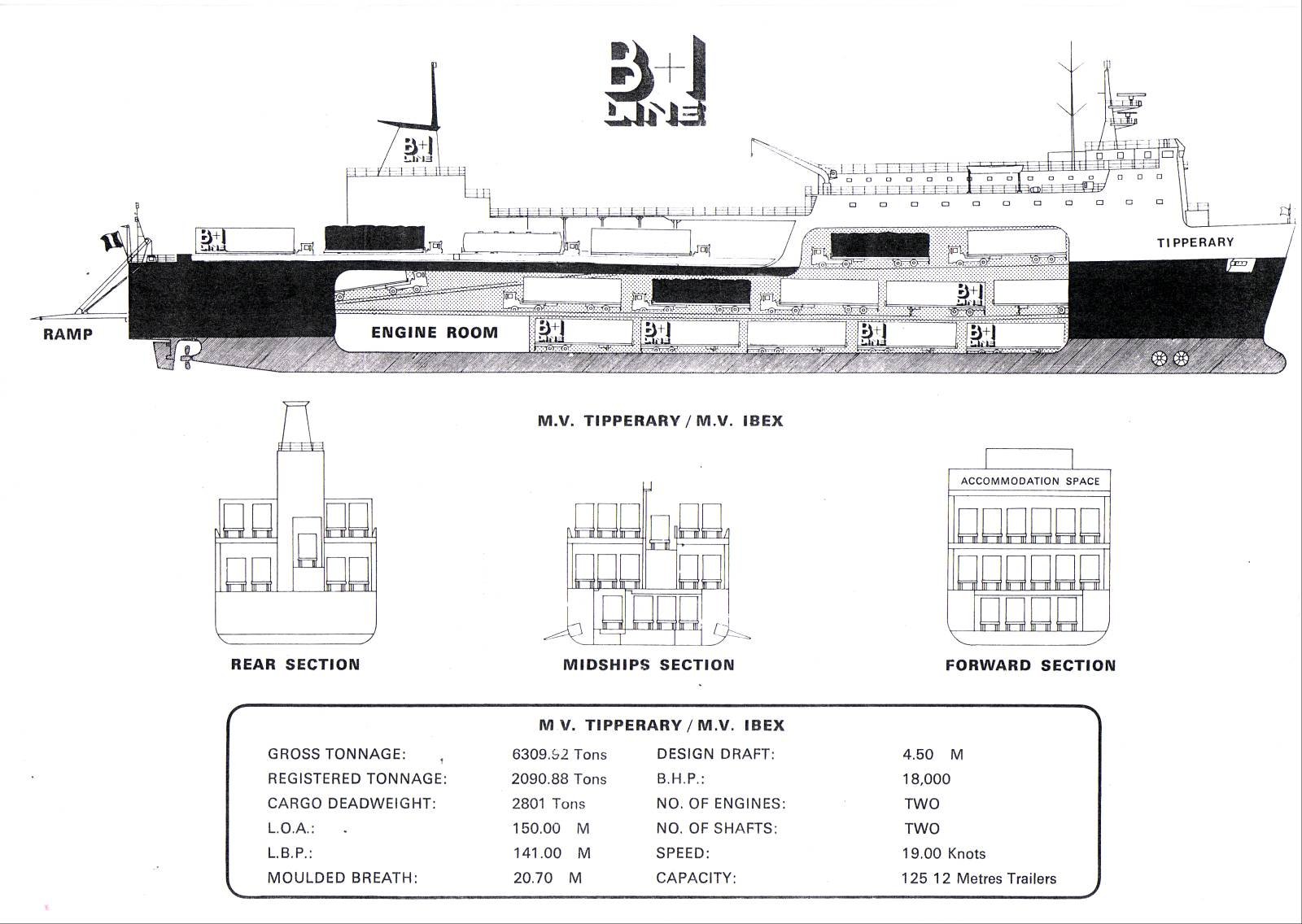

Cut-away deck profile of M.V. Tipperary and sistership of M.V. Ibex

The route's UK port switched to Liverpool in 1988 with Tipperary remaining on the route until sold to North Sea Ferries in 1989 and renamed Norcape. Prior to her transfer to the North Sea, the Tipperary collided with the 4,674grt bulker Sumburgh Head off the entrance to Dublin Port on 18 February 1988. For a report and photo taken of the two vessels which met at the port last year under different names click here.

Like the Tipperary the Sumburgh Head was built in Japan too by Hashihama Zosen KK, Imabari in 1977, yard no. 624. During her Dublin Bay incident, the vessel was owned by Christian Salvesen (Shipping) Ltd based in Edinburgh.

In 1990 she was sold to Barra Head Shipping Ltd and renamed Hood Head under the Irish flag. Three years later sold again to the KG Jebsen group and renamed Husnes.

The Panamanian flagged bulker remained with the Norwegian owner until 2003 when sold to her current owners, Wilson Shipowning AS of Bergen and renamed Wilson Tana, this time under the Maltese flag.

Stena to Close Larne-Fleetwood Route

The route has made significant losses over recent years and to running an aging fleet on the 7-hour service. Stena cite that investment in new tonnage was not an option due to higher capitol costs. "No business can continue to carry such losses on an ongoing basis so there is no alternative but to close the route at the end of this year," he added.

The trio of vessels, Stena Leader (1975/12,879grt), Stena Pioneer (1975/14,426grt) and Stena Seafarer (1975/10,957grt) serve the link between Lancashire and Northern Ireland which takes freight, cars and their passengers but does not cater for 'foot' passengers.

Late last month a fire took place in the engine room of the Stena Pioneer during a sailing to Fleetwood, the fire was extinguished using onboard equipment and fortunately without incident to crew or passengers.The Stena Pioneer was operated by B&I Line as their Bison in a joint service with Pandoro on the Dublin-Liverpool route between 1989-1993.

Under the new agreement, Stena Line's take-over of Belfast-Heysham, the port is a close neighbour to Fleetwood will include the 13,000 tonnes sisters Hibernia Seaways and Scotia Seaways.The other route aquired is Belfast-Birkenhead (Liverpool) which is significant in that the deal will include the purchase of the chartered 27,000 gross tonnes ro-pax twins, Mersey Seaways and Lagan Seaways. The sisters were built in 2005 at the Visentini shipyard, Italy, which also built the ro-pax sisters Dublin Seaways and Liverpool Seaways.

Measuring 21,000 gross tonnes these vessels operate Dublin-Birkenhead route but remain under DFDS Seaways control and this applies to their freight-only service from the Irish capital to Heysham served by the Anglia Seaways. The 120-trailer freight ferry is also a sister of the Belfast-Heysham pair.

Notably the transaction will see Stena Line enter operations on the Mersey for the first time.The Swedish operator will use the river's Birkenhead Twelve Quays ferryport terminal located on the Wirral, opposite the famous Liverpool waterfront.

Stena Line will not only share the double berth facility with DFDS Seaways but also the Isle of Man Steam Packet (IOMSPCo) which in recent years has operated winter sailings to Douglas. In the summer the Isle of Man ferry operator uses the Liverpool landing stage berth on the other side of the river which is also shared by the 'ferry cross the Mersey' fleet operated by Mersey Ferries.