Displaying items by tag: bulk liquid

Trade Levels Continue to Grow for Dublin Port

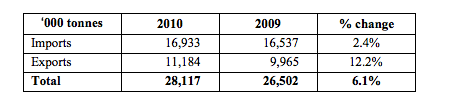

Dublin Port Company today published trade statistics for 2010 which showed an increase in the port's volumes of 6.1% in 2010.

Total throughput for the year was 28.1m tonnes which is less than 10% down from the port's best ever performance in 2007 at the height of the boom. Export traffic was particularly strong with 12.6% growth in the year.

Growth was concentrated in the unitised modes but was partially offset by declines in bulk liquid and bulk solid cargoes due directly to the sluggish performance of the economy.

The volume of Ro-Ro freight units increased by 12.8% to 725,665 which is less than 1% down from the port's highest ever throughput. This performance confirms Dublin Port as the island's premier port for Ro-Ro. Growth in the year was driven in part by the new CLdN Ro-Ro services to Zeebrugge and Rotterdam.

Growth in Lo-Lo container volumes was 1.1% with an outturn of 554,259 TEU in 2010.

Dublin's position as the island's largest unitised port was reinforced by the commencement of rail freight services linking Dublin to Ballina. Demand for these services continues to grow and during 2011, we expect rail freight to remove up to 10,000 trucks from the road.

Further underpinning Dublin Port's popularity among RoRo shipping lines was the decision by Seatruck Ferries yesterday to announce a new freight- only service linking Dublin with Heysham which will commence Monday 14 Feb 2011.

Imports of fuel oil products (motor fuel and aviation spirit) dropped 6.5% in the year to 3.8m tonnes. Notwithstanding this decline, Dublin Port remains the country's most important port for oil imports, accounting for more than 50% of national demand.

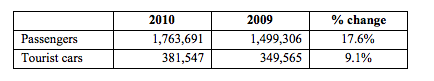

In the bulk solid mode, there was a 7.9% decline to 1.5m tonnes in the year due to the continued decline in demand for construction materials. Trade cars imported through Dublin Port doubled to 47,249 in the year and there was also a strong performance in the ferry passenger business with numbers up 17.6% to 1.8m.

In addition to the ferry business, Dublin Port remained the country's largest port for cruise ship visits with 85 cruise ship calls bringing 130,000 tourists and crew to the city during the year.

Discussing Dublin Port Company's outlook for trade levels in 2011, Eamonn O'Reilly, Chief Executive of Dublin Port Company, said:

"2010 was an exceptional year for Dublin Port. Notwithstanding the poor performance of the economy, port volumes grew by 6.1% as importers and exporters sought to minimise the cost of moving goods to market. Passenger and tourism volumes were also very buoyant as the benefits and reliability of ferry travel became clear particularly during the ash-cloud crisis.

"For 2011, we are projecting continued growth, albeit at a reduced level compared to 2010."Dublin Port's success is due to its location at the centre of the largest concentration of population on the island and also to the exceptional connections to the national road and rail networks. Dublin is close to the main markets, and shipping services are available from a wide range of excellent ferry and container lines offering importers and exporters competitive and reliable routes to market. We are very conscious of the central role Dublin Port plays in facilitating merchandise trade, the value of which is in excess of 80% of Ireland's GDP, and we are committed to continuing to develop the port in line with the needs of the economy and funded from our own resources."

Dublin Port Company's Annual Report for 2010 will be published later in the year.