Displaying items by tag: IMDO

The iShip Index outlining trends within Ireland’s shipping industry grew by 5% in 2021, the Irish Maritime Development Office says.

The IMDO’s iShip Index is a quarterly weighted indicator that accounts for five separate market segments, representing the main maritime traffic sectors moving through ports in the Republic of Ireland.

These comprise unitised trade which includes lift-on/lift-off (LoLo) and roll-on/roll-of (RoRo), and bulk traffic which includes break bulk, dry bulk and liquid bulk.

The IMDO says 2021’s figure is the fastest rate of growth in the index since 2017, and represents a return to the volumes of freight handled in 2018 and 2019 after the suppressive effect of the COVID-19 on port traffic.

Just over 54 million tonnes of freight were handled at Irish ports in 2021, a 2.8 million-ton increase compared to 2020, the IMDO says.

In the dry bulk market, a 10% annual increase compared to 2020 was almost entirely driven by coal. This trend is reflected in port traffic volumes, as imports of coal through Shannon Foynes Port Company rose by over 1.2m tonnes.

In the liquid bulk market, growth of 7% was driven by oil, Ireland’s largest source of domestic energy. Imports of petroleum rose in all three of Ireland’s Tier 1 ports in 2021 as demand for domestic and aviation fuel rose in line with the lifting of COVID-19 restrictions.

Lastly, break bulk traffic across Irish ports rose significantly in 2021, increasing by 12%. This was driven by a return to construction activity in the domestic and international markets after severe restrictions within the sector throughout 2020.

In the unitised freight market, performance in 2021 was defined by two main characteristics. Firstly, 2021 recorded a surge in demand on direct services between the Republic of Ireland and mainland European ports, driven by the post-Brexit transfer of traffic away from the UK landbridge.

LoLo traffic, measured in Twenty-Foot Equivalent Units (TEUs), rose by 12% to 1.17m TEUs, the highest annual volume on record. RoRo traffic on direct routes grew by 94% to an unprecedented level of 383,000 RoRo units.

The second predominant trend that emerged in 2021 was the increase in RoRo traffic at Northern Ireland’s ports.

Through consultations with stakeholders and through detailed analysis of time series trends of RoRo traffic on the island of Ireland, the IMDO says it is clear that haulage companies based in Northern Ireland have transferred significant volumes of business away from RoRo services in ports in the Republic of Ireland.

The IMD suggests that this, along with the move away from the UK landbridge, explains the decline in RoRo traffic between Irish and UK ports in 2021. These volumes declined by 22% in 2021.

Overall RoRo traffic in the Republic of Ireland declined by 3% this year, offset by the surge in traffic on direct services. RoRo traffic in Northern Ireland grew by 12%.

In all, freight volumes through the Republic of Ireland recorded robust growth in 2021, and have returned to levels consistent with those before the COVID-19 pandemic.

Meanwhile, Brexit has had a significant impact on the composition of the Irish RoRo market and has led to unprecedented volumes in the Irish LoLo market.

The Irish Maritime Development Office (IMDO) has published its Unitised Traffic Report for Q3 of 2021 and below is an Executive Summary.

A full report of the various shipping sectors modes is available to download by clicking the attachment link as below.

Roll/on – Roll/off (RoRo):

In Q3 2021, RoRo volumes through ports in the Republic of Ireland (ROI) were consistent with those in Q3 20192. Between July and September, 297,920 RoRo units were handled at Dublin Port, Port of Cork and Rosslare Europort, just 0.02% more than the same period in 2019. However, the configuration of RoRo traffic in terms of route choice and shipping mode has been significantly altered compared to 2019. The following is a summary of the most pronounced trends that have emerged in the RoRo freight market:

71% of all ROI RoRo traffic is now unaccompanied, compared to 64% in Q3 2019. This is the highest share held by unaccompanied traffic on record.

One third of all RoRo traffic in the Republic of Ireland now operates on direct routes to ports in the European Union, up from a 16% share held throughout 2019. In the first nine months of 2021, ROI – EU traffic is already 52% above its annual total for all of 2019. Q3 2021 was one the second busiest on record for these direct routes, surpassed only by Q2 2021.

In terms of capacity, Irish importers and exporters have benefitted from a significant increase in the choice of direct EU services in 2021. After responding to a surge in ‘direct demand’, there are now 13 different direct EU RoRo services available to Irish businesses, compared to 6 in 2019.3

ROI – GB RoRo traffic has declined significantly since January 2021.

Volumes in Q1 2021 were distorted by a pre-Brexit stockpile, combined with strict COVID-19 restrictions in January and February. Q2 & Q3 2021 therefore provide a more reliable insight into current demand on ROI – GB routes. In Q3 2021, ROI – GB volumes fell by 20% compared to Q3 2019.

The volume of traffic recorded in Q2 & Q3 2021 is the lowest since early 2015. In all, for the first nine months of the year, GB traffic has declined by 25% compared to 2019. ROI – GB traffic now accounts 67% of ROI volumes, compared to 84% throughout 2019.

In Northern Ireland (NI), RoRo traffic has reached unprecedented levels. Q3 2021 was the second busiest quarter on record, surpassed only by Q2 2021. In Q3, NI RoRo traffic rose by 11% when compared Q3 2019. All three Northern Ireland RoRo ports, Belfast and Warrenpoint & Larne, have recorded significant growth in RoRo traffic in 2021.

Underpinning all of these trends are the new customs and trading arrangements between Ireland and the UK that came into force on January 1st 2021 after Great Britain’s withdrawal from the European Union. Brexit has had a significant effect on RoRo traffic on the island of Ireland.

The most prominent impact has been on the use of the UK Landbridge, a term used to describe a route to market that connects Irish importers and exporters to international markets via the UK road and ports network. Demand for the Landbridge has fallen considerably, and this has driven the simultaneous decline in ROI – GB traffic and increase in direct ROI – EU traffic.

In addition to the Landbridge issue, some RoRo traffic has also ‘transferred’ away from ROI - GB routes and towards NI – GB routes. RoRo services at ROI ports have historically been utilised by many NI hauliers wishing to access markets in the midlands and southeast of England. From early 2021, it was clear that haulage companies based in Northern Ireland had transferred some traffic away from RoRo services in ROI in order to avoid the new customs requirements involved between Ireland and UK ports.

As detailed in Section 3 (iii), the IMDO estimates that of the displaced ROI – GB RoRo traffic, approximately 80% has moved to ROI – EU services, while the remaining 20% has moved to NI – GB services.

Lift/on – Lift/off (LoLo):

Like RoRo traffic on direct EU routes, LoLo volumes have also reached unprecedented levels in 2021. LoLo traffic through ROI ports set a record in Q2 2021, surpassing 300,000 TEUs for the first time. In Q3 2021, volumes are slightly below this level, at 299,765 TEUs, but remain significantly above the average for the past five years. In Q3 2021, ROI LoLo traffic grew by 13% compared to Q3 2019.

Beginning midway through 2020, LoLo volumes have surged, and have consistently held onto gains made each quarter. Quarterly TEU volumes are now higher than the peaks recorded before the financial crash in 2008.

The vast majority of LoLo services on the island of Ireland are direct to continental EU ports. As a result, many of the factors that have driven a surge in ROI – EU RoRo traffic are applicable to the Irish LoLo market. LoLo volumes have benefitted greatly from the demand from Irish importers and exports to access EU markets directly, without the need to adhere to customs requirements at UK ports since Brexit.

Overall, in the last nine months, the substitutability between accompanied RoRo, unaccompanied RoRo and LoLo services has become more pronounced, with increased competition and dynamic capacity evident in each market.

Passengers

As highlighted in the IMDO’s Q1 & Q2 reports, no Irish maritime market segment has been more severely disrupted by the COVID-19 pandemic and its accompanying restrictions than the market for passengers.

Following the introduction of the EU Digital COVID Certificate in July 2021, the volume of passengers on maritime services in the Republic of Ireland rose significantly. Tourism / passenger numbers in the Republic of Ireland increased by 86% in Q3 2021 when compared to Q3 2020.

In the summer of 2020, many international travel restrictions were still in place, both in the Republic of Ireland and across Europe. When compared to Q3 2019, passenger numbers in Q3 2021 declined by 56%. Since the initial wave of the pandemic in Ireland, this is the closest the industry has come to returning to 2019 passenger levels.

In Northern Ireland, passenger numbers in Q3 2021 have returned to pre-pandemic levels.

IMDO at London International Shipping Week (LISW21)

The Irish government's development, promotional and marketing office for the shipping services sectors, the IMDO is among the sponsors of the high-profile biennial London International Shipping Week, writes Jehan Ashmore.

The Irish Maritime Development Office (IMDO) sponsor role in the premier global and maritime event week (13-17 Sept) is where the LISW21 provide an opportunity for the international and UK maritime community to get back together again. This time face-to-face and for the first time since the COVID-19 pandemic started.

During LISW's 'must attend ' events, this will offer up to 250 in-person, hybrid and virtual industry functions and unique networking opportunities for leaders across all sectors of the international shipping industry and the UK shipping industry. Take a click here for conference speakers and panelists.

Among the events Afloat has consulted is the Coastal Shipping Seminer, to be held tomorrow, Wednesday, 15 Sept. Attendees will gain new insights into coastal shipping and understand how to revolutionise the green supply chain. To register this British Ports Association seminar, click this link for the event attended by ports and shipping operators.

As for the high profile LISW21 Conference (also tomorrow) this is to take place at the International Maritime Organization’s (IMO) headquarters on the Thames along Albert Embankment in central London.

In addition a glittering black tie Gala Reception and Dinner held aptly in the National Maritime Museum downriver in Greenwich is on Thursday, 16 September. This key event will attract the very highest-level from the UK government and shipping industry leaders across the UK and from around the world.

For further details of LISW21 there is the Official Event Guide (click to download) which is packed with information on this year’s premier global shipping and maritime event.

The events (calender) will be held by international shipping and marine trade associations and the UK Government, as well as by official sponsors of the week.

Both face-to-face and virtual events will take place, and seamlessly be blended via the dedicated LISW21 Portal. To access the portal and register for free online events click here.

During the week of LISW, a daily breakfast morning news programme is podcast from 7am

Irish Maritime Transport Economist Report Reveals One of the Most Challenging Years In Decades

The Irish Maritime Development Office (IMDO) has announced the publication of the 18th edition of the Irish Maritime Transport Economist.

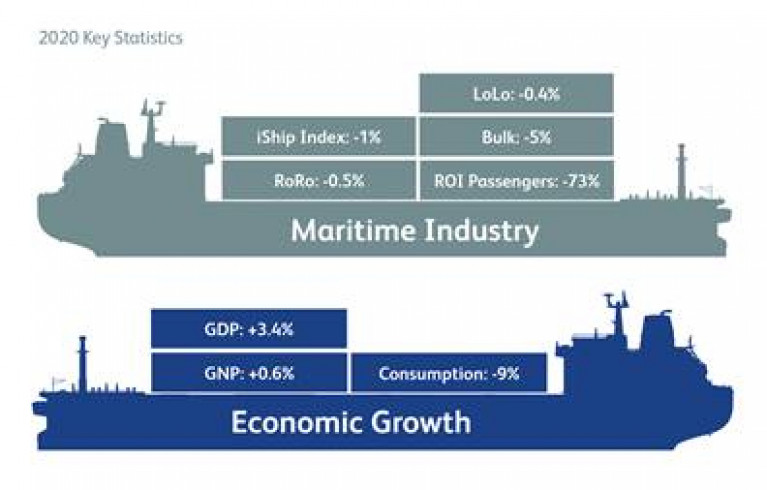

In this edition, we report on 2020, one of the most challenging years that the Irish maritime industry has faced for many decades.

The outbreak of COVID-19 in Q1 had a dramatic and negative effect on freight and passenger volumes. Public health concerns necessitated the imposition of restrictions on the movement of people, internationally and domestically.

In the early months of the pandemic, passenger volumes fell by over 90%, while RoRo freight volumes fell by over 25%. Although other shipping market segments were not immune to the suppressive economic effects of the public health restrictions, their impacts were not as deep or as lasting as those experienced in the RoRo freight and passenger segments.

The second half of 2020 stands in marked contrast to the first half, from a RoRo and LoLo freight perspective. The losses of the first half of the year were recovered, as initial public health restrictions were eased and most retail activity recommenced in Q3.

Moving through Q4, combined RoRo and LoLo freight volumes set a new record of 1,324 points on the IMDO’s iShip Index for unitised trade. Unitised volumes were bolstered by the desire of traders to create stockpiles in advance of the year-end Brexit deadline. RoRo and LoLo volumes in Q4 were sufficient to make good earlier losses and bring overall unitised throughput for the year to just 1% below 2019 levels.

The restrictions on international travel introduced in Q1 remained in place, resulting in passenger volumes falling by 73% for the year. Bulk trades were also negatively affected by lockdown measures. Market demand for bulk materials, particularly in the construction and transport sectors, fell significantly.

The COVID-19 pandemic and preparations for Brexit placed unprecedented pressure on the maritime industry in 2020. The response of the industry to the COVID-19 outbreak has been remarkable, from both an operational and a health and safety perspective.

Connectivity to international markets was maintained, supply chains were protected and measures were put in place to protect the health and safety of users of (Irish) ports and shipping services. All of this was achieved while preparations ramped up for the UK’s departure from the EU, the result of which involves a new regime of border controls and inspections in our ports. This work was undertaken with commitment and professionalism by all workers in our maritime industry, who are deserving of our thanks and admiration.

In conclusion, may I take this opportunity to wish all those involved in the maritime transport sector success in the vitally important work they do in maintaining and expanding Ireland’s trade links with the rest of the world and in driving growth, efficiency and competitiveness in our economy.

The effects of COVID 19 continue to be felt in the maritime industry, but the resilience that the industry has demonstrated in recent times and the growing success of the Government’s vaccination programme, give cause for optimism in the industry’s to bounce back and contribute to the recovery the Irish economy.

The European TEN-T Coordinators for the Motorways of the Sea and the Atlantic and North Sea-Mediterranean Corridors have organised an online joint workshop on smart and sustainable maritime transport in the Atlantic and North Sea region post-Brexit over two days next week.

‘Ensuring connectivity between Ireland and continental EU post-Brexit: the role of maritime links’ next Thursday 22 April from 9am to noon Irish time will see representatives from the ports, shipping, business and logistics sectors come together for the first of exciting panel discussions.

This first half-day panel will focus on the impact of Brexit on Ireland’s maritime links to date, while the second will examine what the future holds for Ireland’s maritime connections to continental Europe.

Opening remarks at the event will be delivered by Minister of State for International and Road Transport and Logistics, Hildegarde Naughton. To register for this panel, click HERE.

Then on Friday 23 April, the joint working group on ports will meet from 9am to 12.30pm Irish time for three panel discussions focussed on digitalisation, greening and hinterland connections of ports in the Atlantic and North Sea basins. To register for this second panel, click HERE.

Both events are co-organised by the TEN-T European Coordinators for Motorways of the Sea, Professor Kurt Bodewig; the TEN-T North Sea – Mediterranean Corridor, Professor Peter Balazs; and the TEN-T Atlantic Corridor, Professor Carlo Secchi. Find the full agenda on the IMDO website.

Shipping Lines in Light of Brexit will Set up New Routes to Europe to Meet Demand, Says IMDO

Companies in the shipping industry, reports The Irish Times, will respond to “unanswered demand” for more direct ferry services to mainland Europe if Brexit congests the key UK “landbridge” route, the State’s maritime development agency said.

Hauliers have said the increased frequency of sailings between Ireland and Cherbourg in France to a daily service from January was welcome but that it would not serve as a substitute to the speed and ease of transit currently, before Brexit comes into effect, over the landbridge.

Liam Lacey, director of the Irish Maritime Development Office (IMDO), urged importers and exporters shipping goods to and from Europe to “trial” direct routes between now and January when Brexit border checks begin to see if they work as alternatives for their supply chain.

EU-UK border checks from January mean that transport companies and hauliers face delays at British ports on the Irish Sea and English Channel, potentially disrupting the fastest and cheapest transit route currently between Ireland and mainland Europe.

Mr Lacey acknowledged that Brexit-related delays on the landbridge, jeopardising time-sensitive cargos, could force companies to change their business models and supply chains.

“I don’t underestimate the difficulty about that,” he said. “People need to understand that they will have to consider changing the way they operate. It might be a short-lived thing until the landbridge settles down but we just don’t know that.”

More here from the newspaper and a response from the Freight Transport Association of Ireland as Afloat also reported yesterday.

Transport Association Casts Doubt on Brexit Shipping Report

In Ireland a leading freight organisation has questioned a new government report which suggests that there is sufficient alternative capacity on continental shipping routes in the event of major delays at British ports following Brexit.

As Afloat reported on Friday, the Irish Maritime Development Office (IMDO) published a report that said it does not believe the government needs to intervene to provide extra services for hauliers using the landbridge at present.

For more the Business Post reports on the Freight Transport Association of Ireland's response on the report's conclusion.

IMDO To Marine Transport: ‘ACT Now & Prepare to Switch’ Before Brexit

‘ACT now and Prepare to Switch’ — that’s the message to the logistics and maritime transport sectors from the IMDO as the prospect of a disorderly Brexit looms.

The two-part strategy for stakeholders begins with ACT, or Assess, Communicate, Trial.

As highlighted by the Government since 2018, Irish industry needs to assess supply chains to avoid disruption on the UK landbridge from 1 January 2021.

There is maritime capacity available on both existing and new services to transport goods directly to Continental Europe across different modalities (RO/RO, CON/RO, LO/LO), which represent reliable alternatives to the landbridge.

Now is also the time to communicate your requirements to shipping companies.

There are multiple options to avail of new routes and new services. If there is a level of demand, shipping companies have demonstrated that they will respond to exporters’ needs — the latest being CLdN, which has indicated it can “dramatically” increase its direct services to the Continent if need be.

The next step is trial — work now with your logistics provider or shipping companies to trial new options well in advance of any changes after the Brexit transition period ends.

Stakeholders should Prepare to Switch to direct services to the Continent to protect their route to market and avoid disruption on the UK landbridge. This is especially important if:

- Your supply chain needs a lead in time to make alternative arrangements on the Continent;

- Your produce is time-sensitive;

- Customs procedures will cause unmanageable delays and costs to your business;

- There is a risk to your business in switching routes and this needs to be trialled well in advance.

For more information on planning for Brexit, see gov.ie/Brexit

Round Table Discusses Ireland’s Offshore Wind Energy Ambitions

SSE Renewables recently hosted a virtual round table discussion with key stakeholders in the wind energy industry, examining their role in delivering on the Irish Government’s ambition for offshore wind energy.

Among those taking part was Paul Brewster of the Irish Marine Development Office (IMDO), who was involved in supporting the work of the Development Task Force nearly five years ago as part of Ireland’s integrated marine plan, Harnessing Our Ocean Wealth.

Offshore renewable energy was identified at the round table as a big growth area that could make a significant contribution to a step change in our ocean economy.

SSE Renewables, which is planning the expansion of Ireland’s first operating wind farm at Arklow Bank, says the policy and supports needed for the industry have now aligned.

And while all stakeholders had concerns about delays to foreshore licensing legislation, the industry has moved from hoping for progress to planning, and the conversations have become more commercially focused.

Read the full report from this round table discussion on pages 22-27 of the latest Eolas Magazine.

IMDO Represents Irish Ports In New ’Network Of Excellence’ Towards The Port Of Tomorrow

DocksTheFuture, the European Commission-funded project aimed at defining the vision for the ports of the future in 2030, has announced the launch of a ‘Network of Excellence’.

The Irish Maritime Development Office (IMDO) represents Irish ports in this network with gathers the most innovative ports to encourage development of innovative projects towards achieve their targets under the UN’s 2030 Sustainable Development Goals.

Preliminary core topics will focus on energy efficiency (eg cold ironing, smart grid), alternative fuels (bio-fuels, hydrogen), sustainable and resilient transport infrastructure system, emerging technologies and digitalisation across the logistics chain, cyber security, innovative financing tools, multimodal transport, city-port relations and the circular economy.

The Network of Excellence promotes ideas for the Port of the Future, overcoming the ports and shipping industry challenges of today and tomorrow with practical innovative ideas and best practices, promoting useful new technologies — and improving dialogue with and among the likes of international associations and maritime clusters.

The Network of Excellence — which is open to co-operation with any organisation from maritime and logistics interested in contributing — will soon offer calls for proposals as it engages members through digital channels, as well as in-person events where possible.